Macroeconomic and financial environment

The euro area economy continued to grow in 2018, albeit at a slower pace than in 2017, in line with the maturing global economic cycle. Global growth deceleration is reflected in the slowdown of both advanced economies and emerging markets. Still, the euro area economy is supported by improvements in labour markets, the accommodative monetary stance, and the available fiscal space in some countries. These fundamentals should support a gradual adjustment to weaker global activity. The outlook remains positive, but the overall balance of risks tends to the downside due to trade disputes, Brexit, and geopolitical tensions.

Euro area economic performance moderates

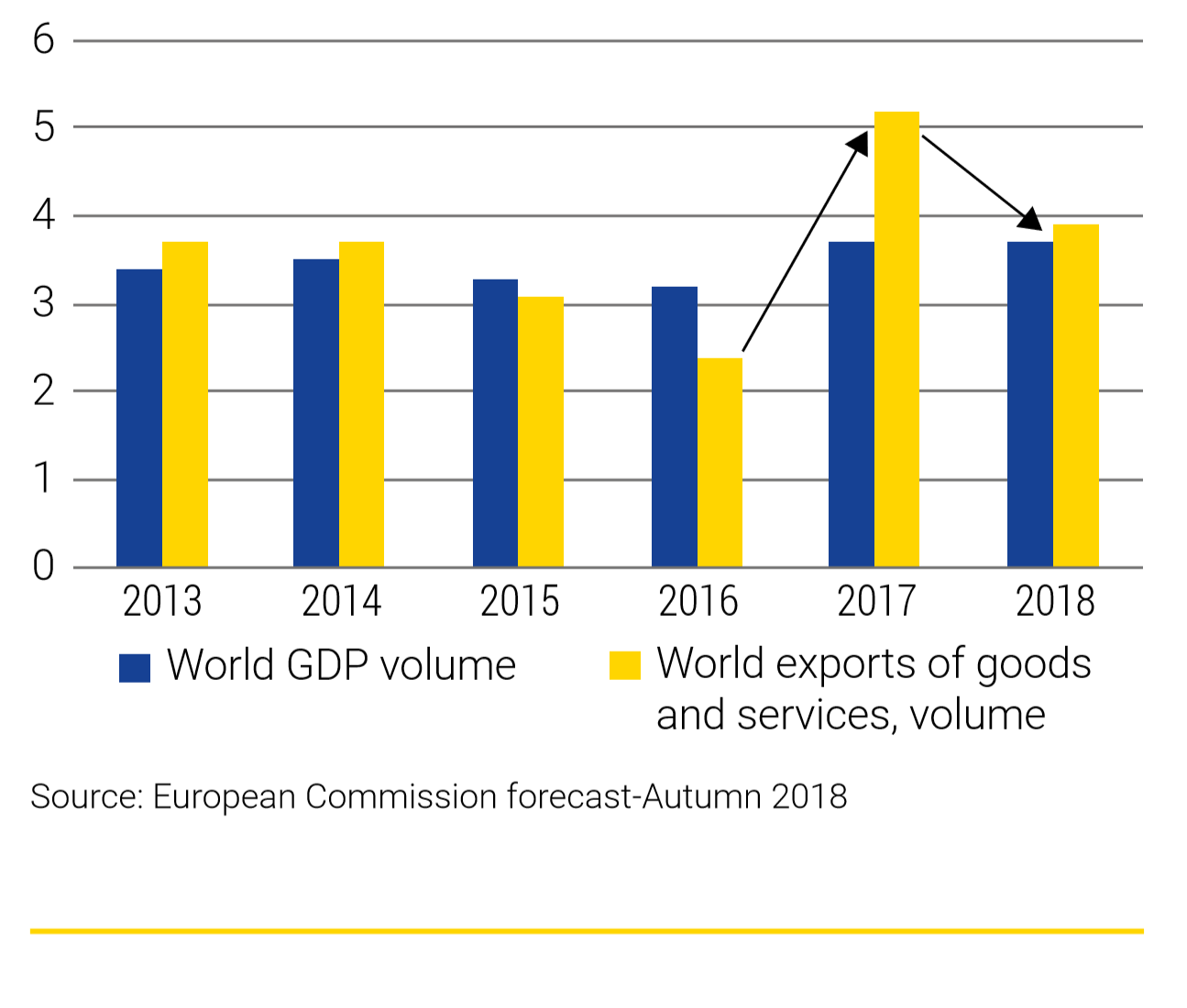

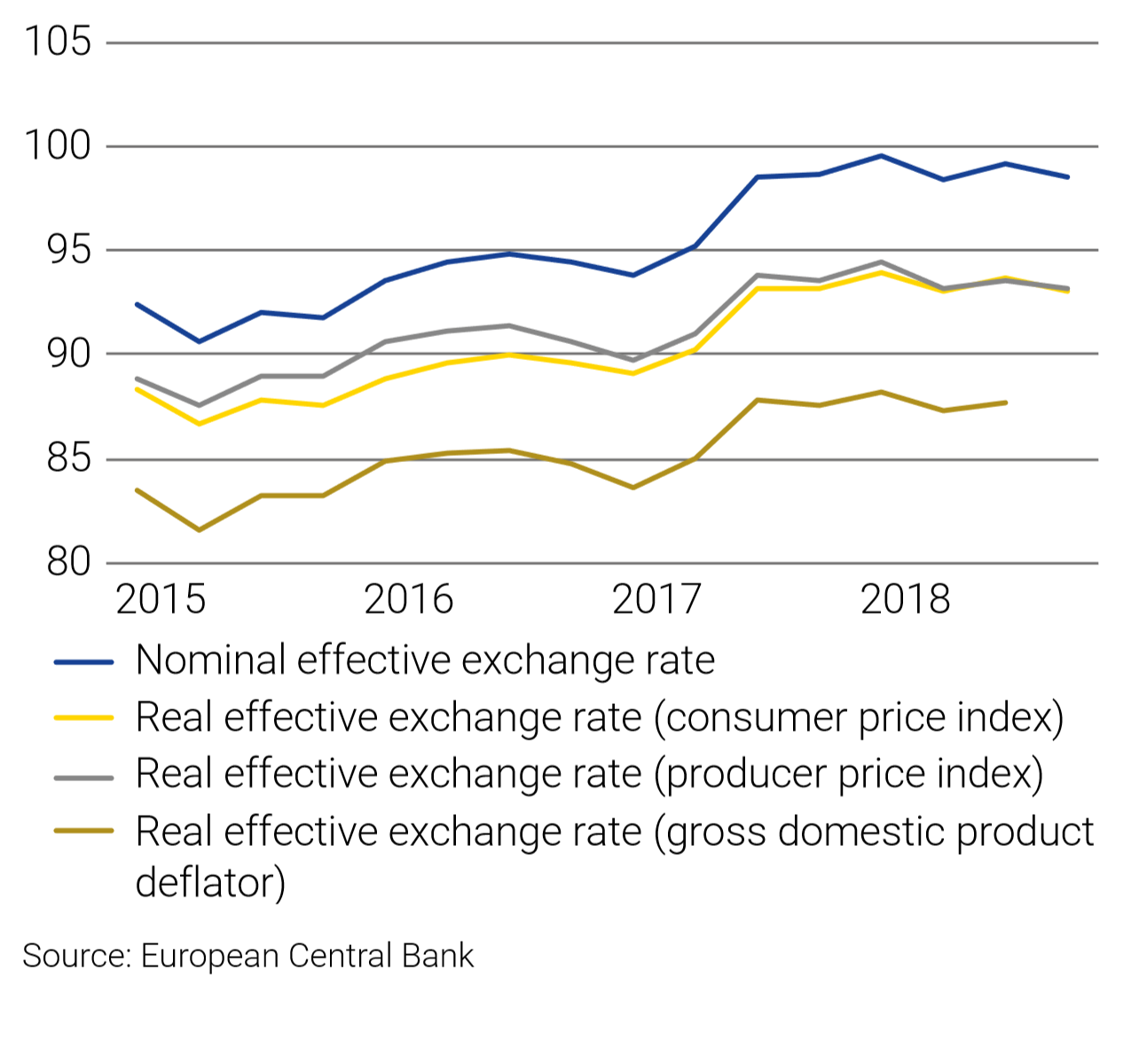

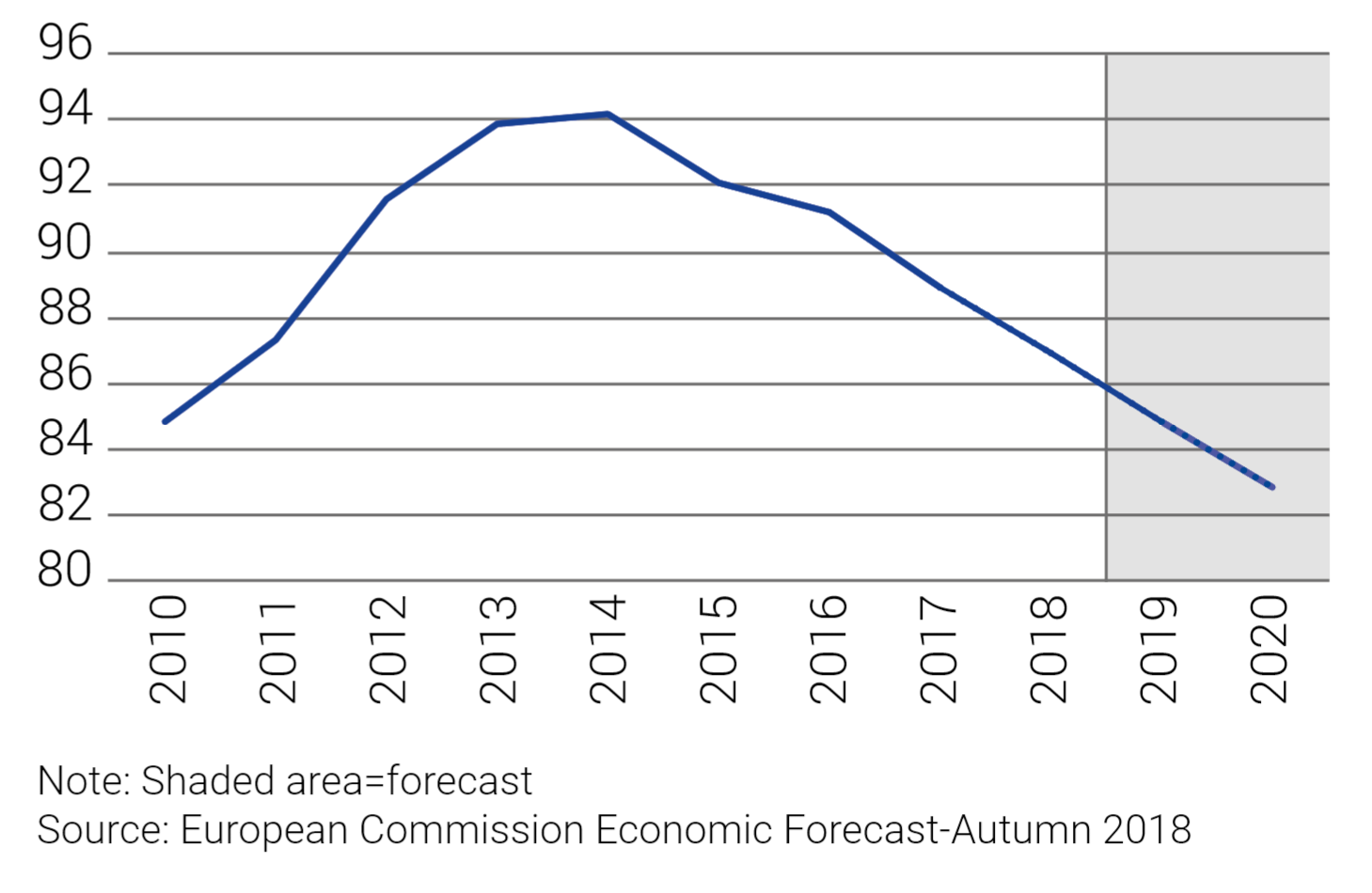

After the peak of economic growth in 2017, euro area growth slowed, following the cyclical downturn of the global economy. In addition to a maturing cycle, trade disputes and Brexit have set a less dynamic path for global trade that, starting from 2018, is expected to converge with lower world gross domestic product (GDP) growth (Figure 1). Oil prices continued to fall while the euro exchange rate (Figure 2) remained broadly stable in nominal terms. US growth held up on the back of fiscal stimulus, but its impact is fading, adding to the downside risks for the euro area.

Figure 1: World economic activity and exports of goods and services

(y/y growth, in %)

(y/y growth, in %)

Figure 2: Euro effective exchange rate

(Group of 19 countries, Q1/1999=100)

(Group of 19 countries, Q1/1999=100)

Euro area GDP growth eased to 1.8% in 2018 after expanding by 2.4% in 2017. Apart from weaker external demand, some temporary factors affecting the car industry in the second half of 2018 contributed to the overall deceleration.

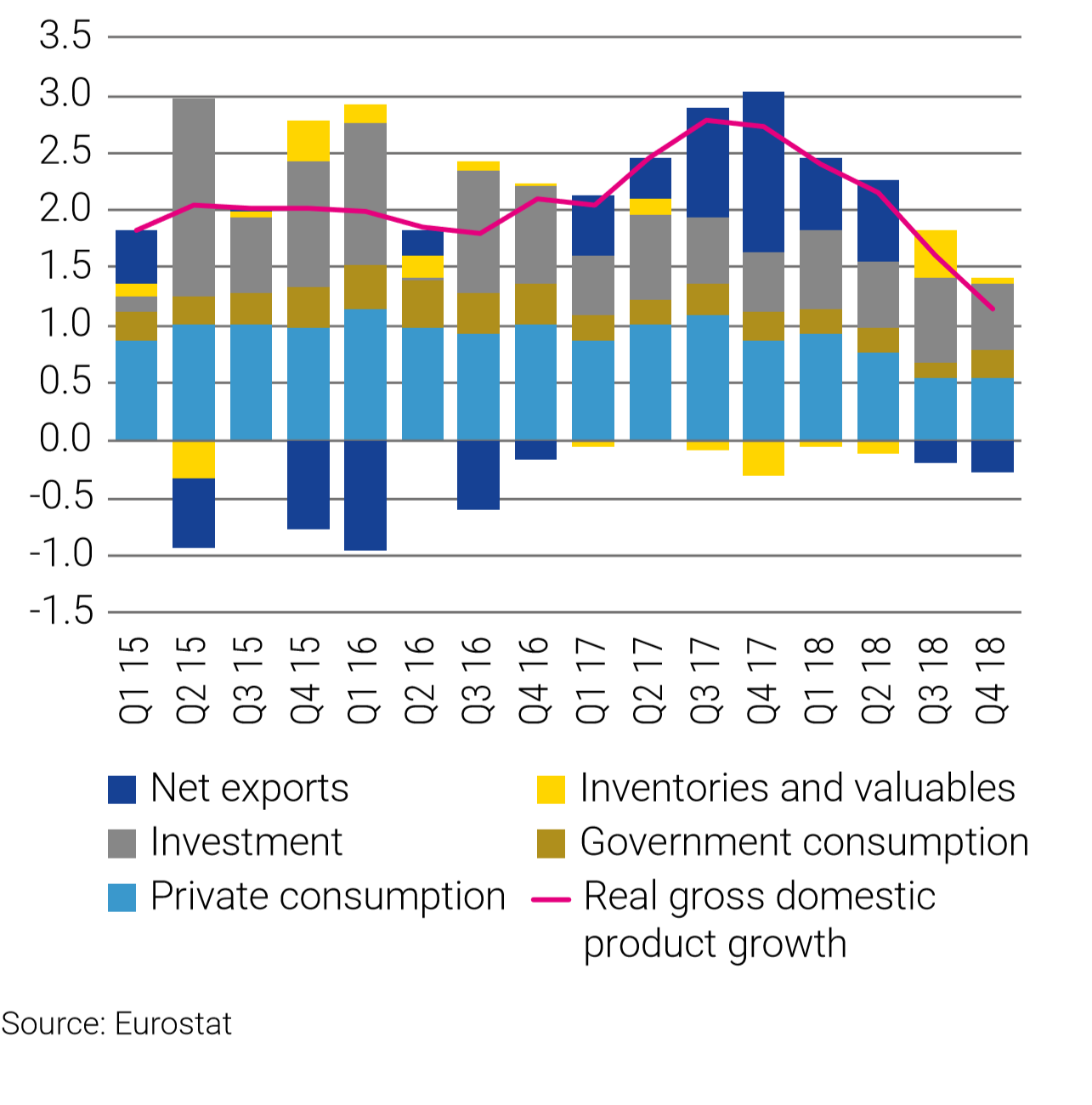

The composition of euro area GDP also reflects the weaker global environment (Figure 3). After sizeable positive contributions in 2017 and the first half of 2018, net export contribution to growth turned negative. This impact is partly offset by the build-up of inventories mostly seen in the third quarter and to a great extent related to the abovementioned one-off factors. Both investment and total consumption remained robust pointing to improvements in the business climate and labour market recovery followed by considerable wage increases.

Figure 3: Contributions to real gross domestic product growth

(y/y growth in %, contributions in percentage points)

(y/y growth in %, contributions in percentage points)

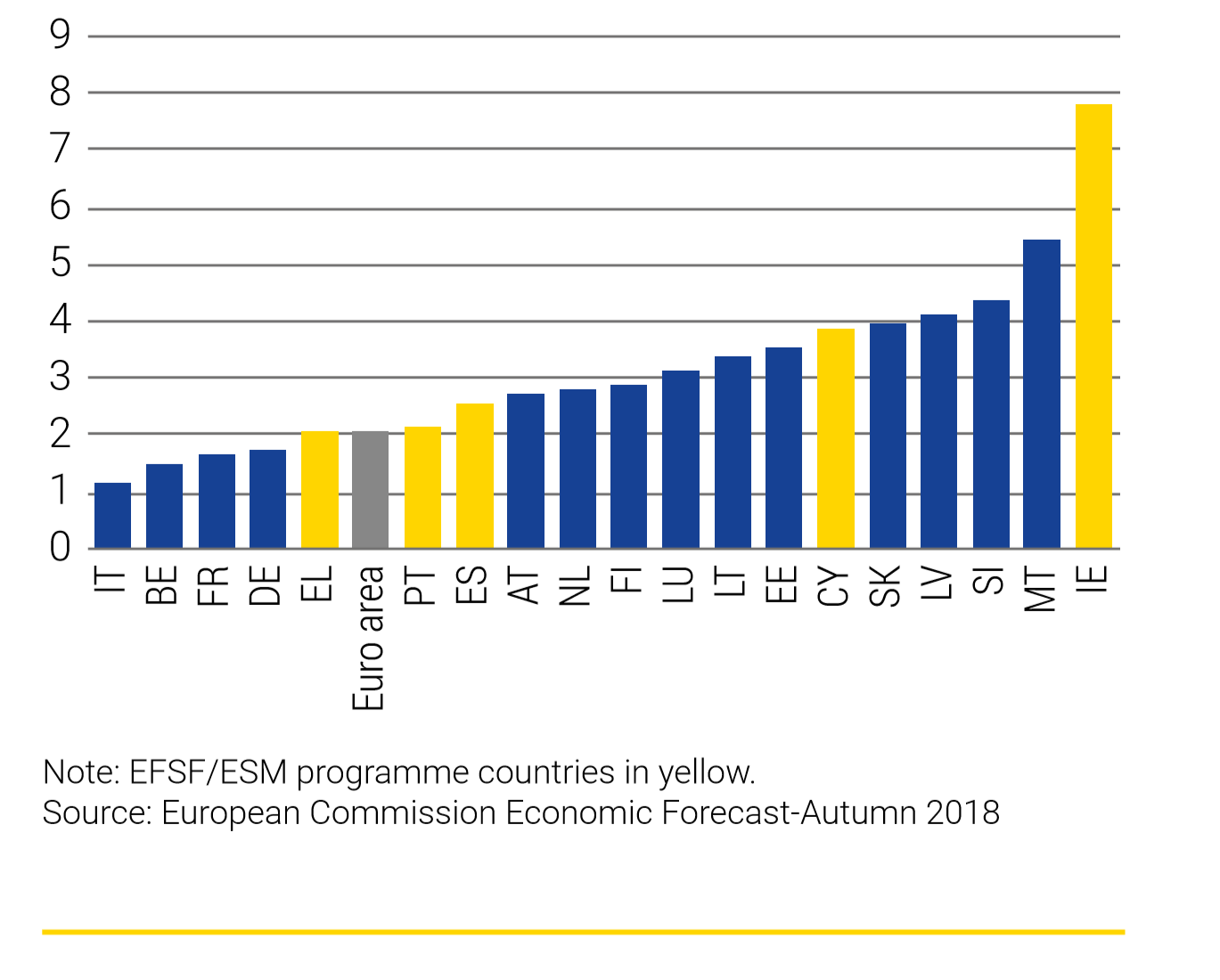

The slowdown appears to be synchronised, with all large euro area countries recording more moderate growth rates (Figures 4 and 5). While countries differed noticeably in their cyclical position and labour market improvements, the synchronised slowdown could also delay further convergence of euro area members.

Figure 4: Real gross domestic product growth in 2018

(in %)

(in %)

Figure 5: Real gross domestic product growth for selected countries

(y/y growth in %, quartely data)

(y/y growth in %, quartely data)

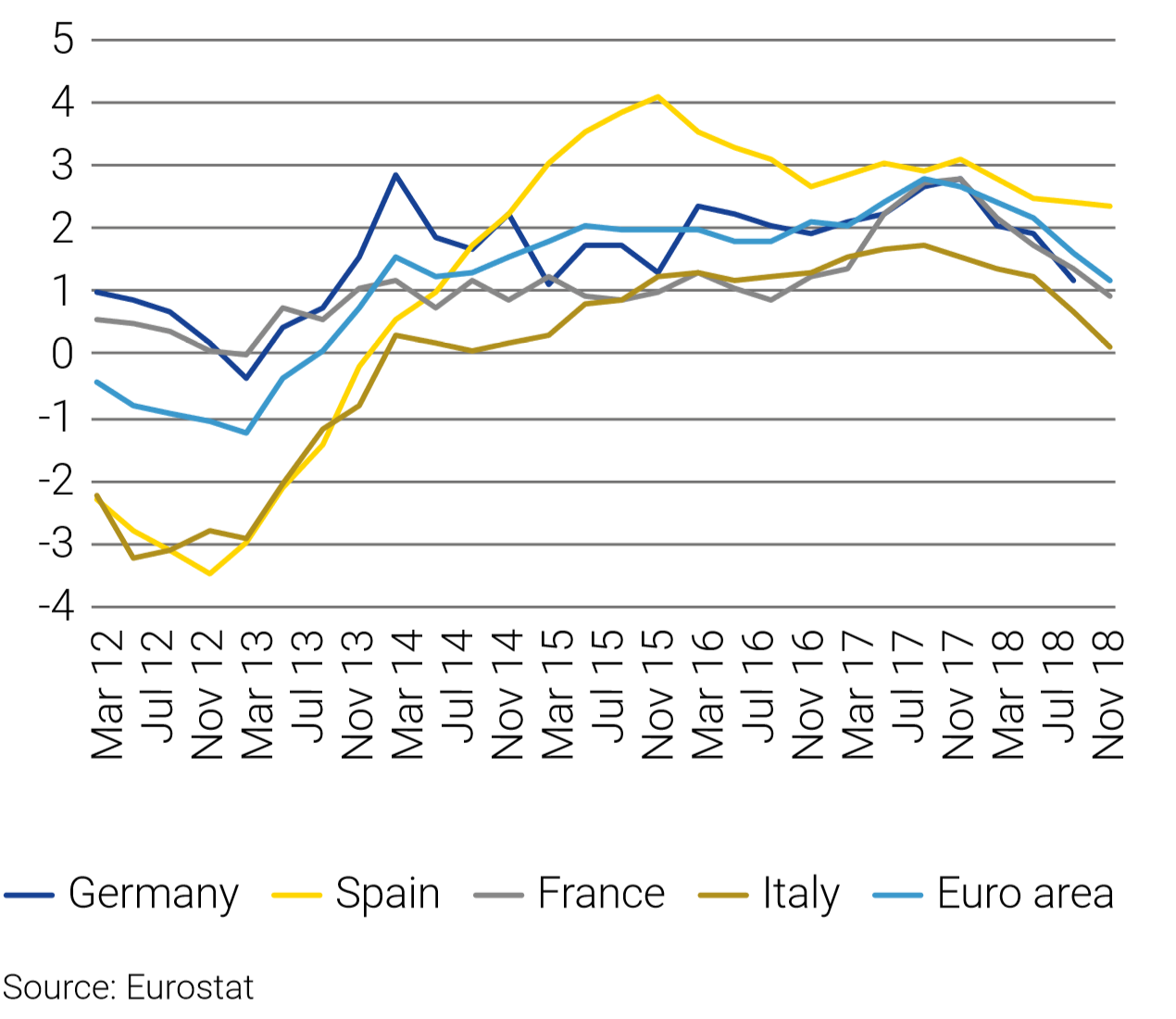

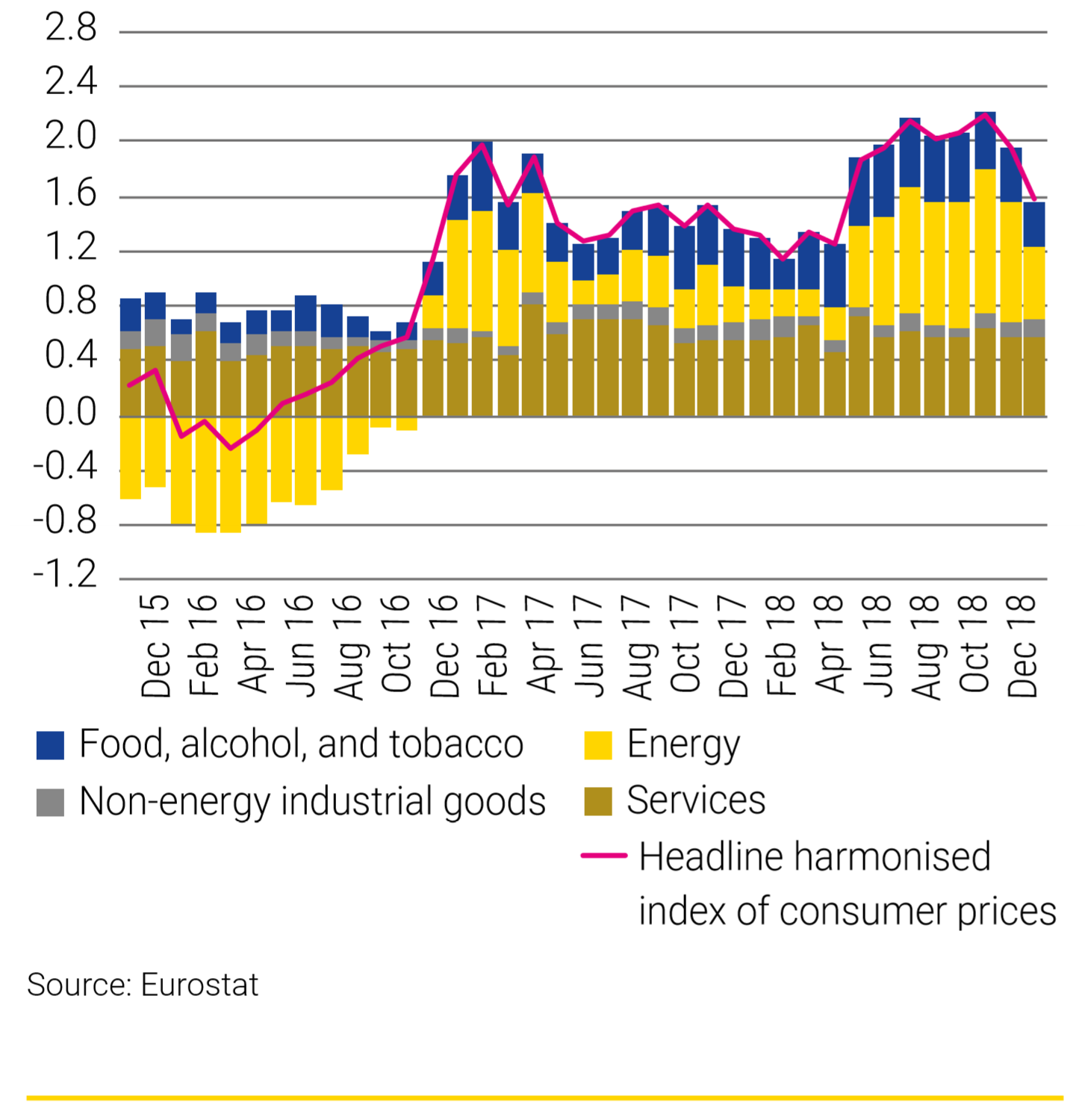

Euro area inflation reached a six-year high in 2018, averaging 1.7% over the year, up from 1.5% in 2017 (Figures 6 and 7). The slight upswing was mostly driven by the energy component given the recovery in oil prices. Core inflation, measured as headline inflation excluding unprocessed food and energy prices, marginally accelerated to 1.2% from 1.1% in 2017. Inflation expectations rose over the year, supported by the oil price recovery and broad-based wage acceleration among euro area member states, which should support core inflation in the future.

Figure 6: Contributions to harmonised index of consumer price inflation rate

(y/y inflation in %, contributions in percentage points)

(y/y inflation in %, contributions in percentage points)

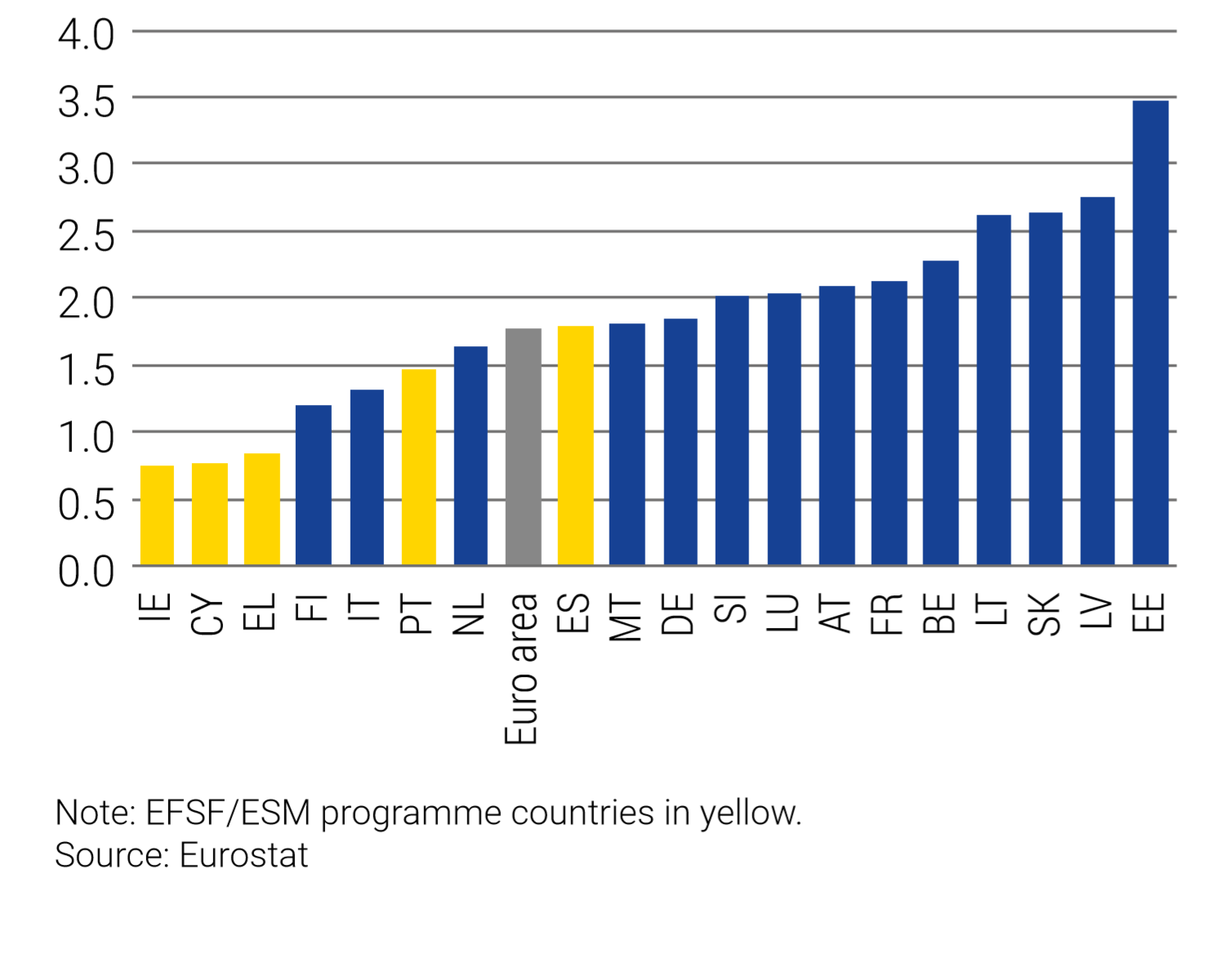

Figure 7: Harmonised index of consumer price inflation rates in 2018

(in %)

(in %)

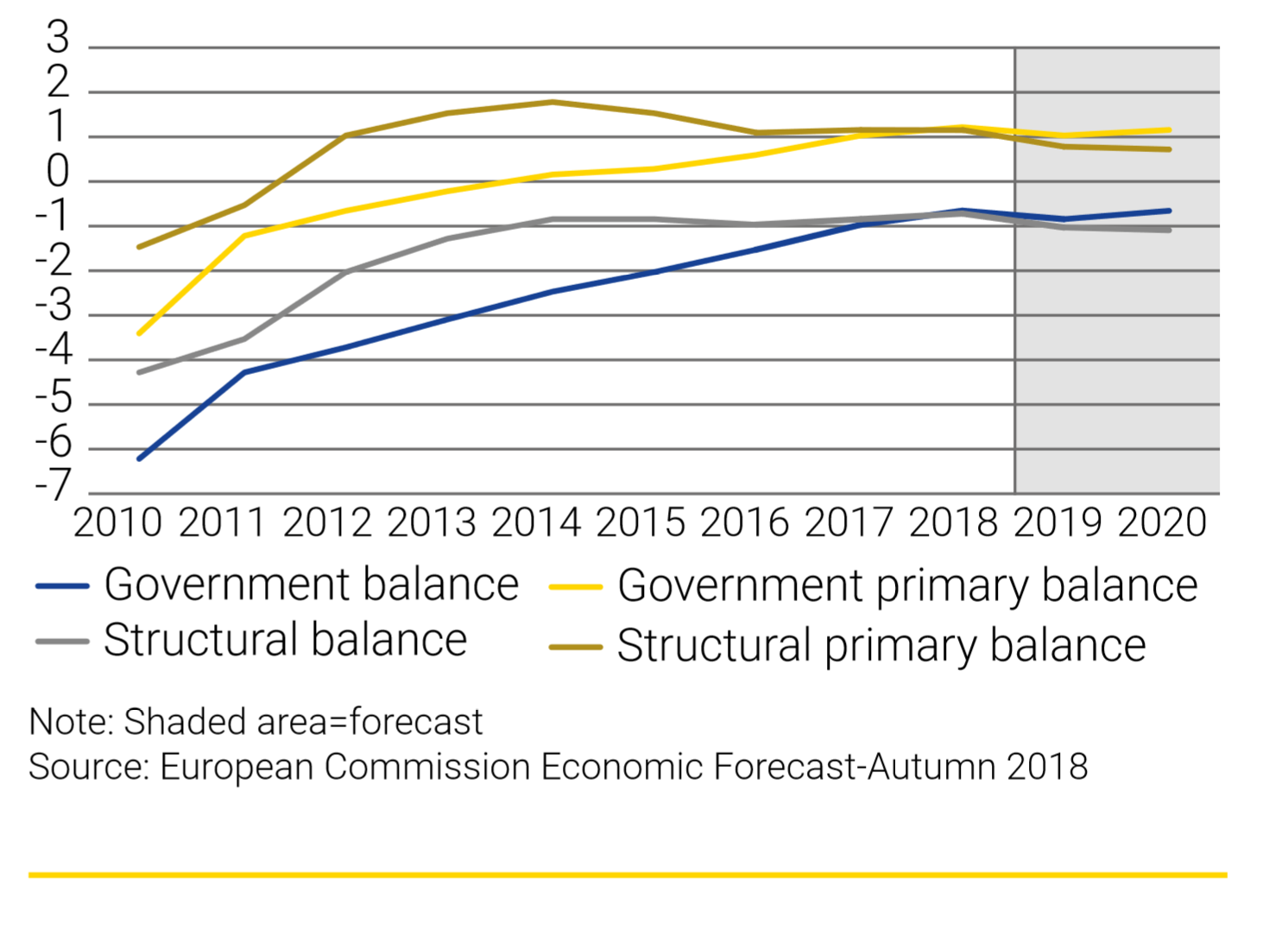

Fiscal balances in the euro area continued improving in 2018 in an environment characterised by favourable borrowing conditions (Figure 8). Low financing costs and cyclical conditions helped governments to compensate for the lack of improvement in structural balances, particularly for countries with high levels of debt. Overall, debt dynamics at the euro area level remained favourable as the debt-to-GDP ratio continued its decline (Figure 9).

Figure 8: Euro area budget balances

(in % of GDP)

(in % of GDP)

Figure 9: Euro area government debt

(in % of GDP)

(in % of GDP)

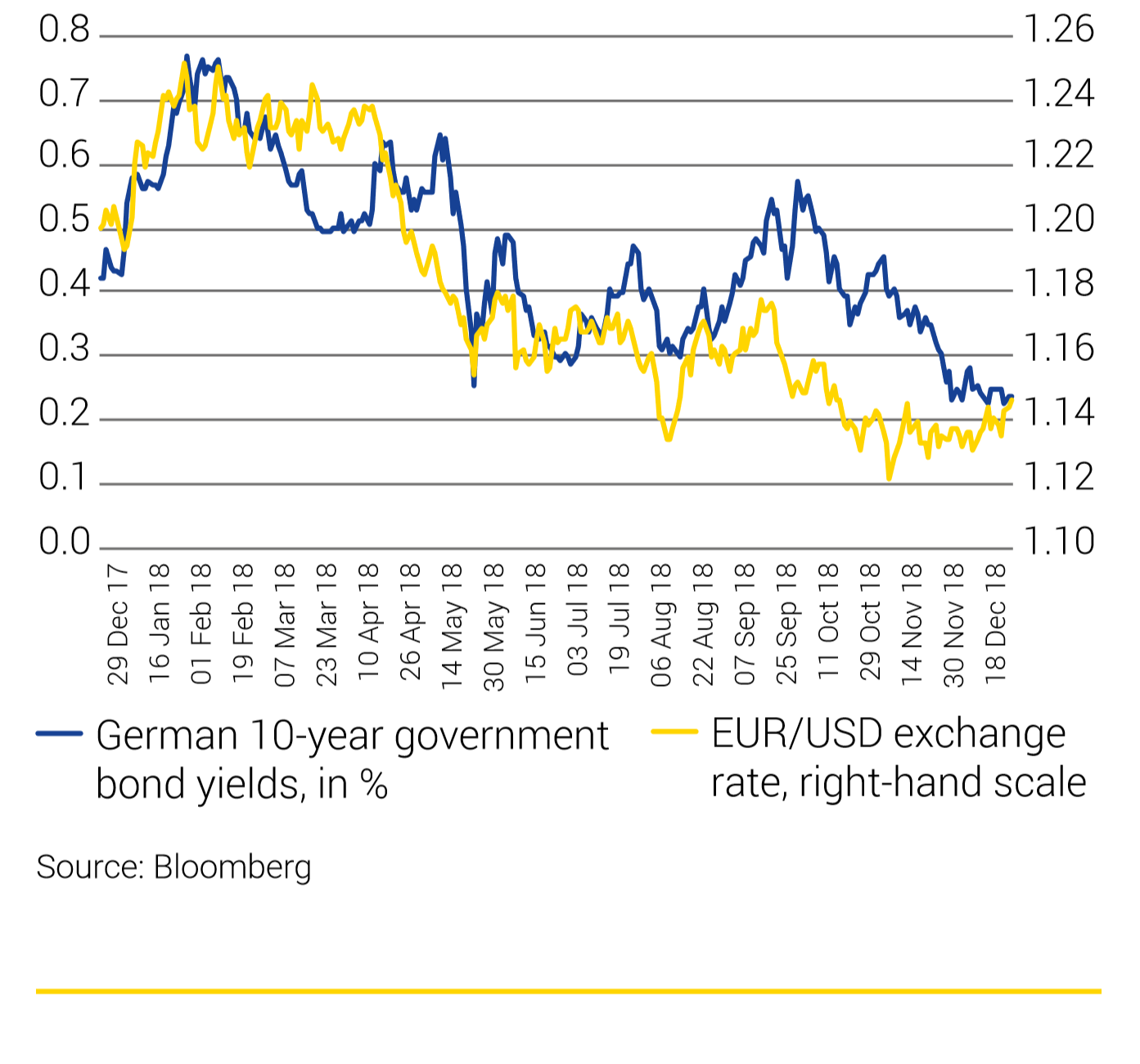

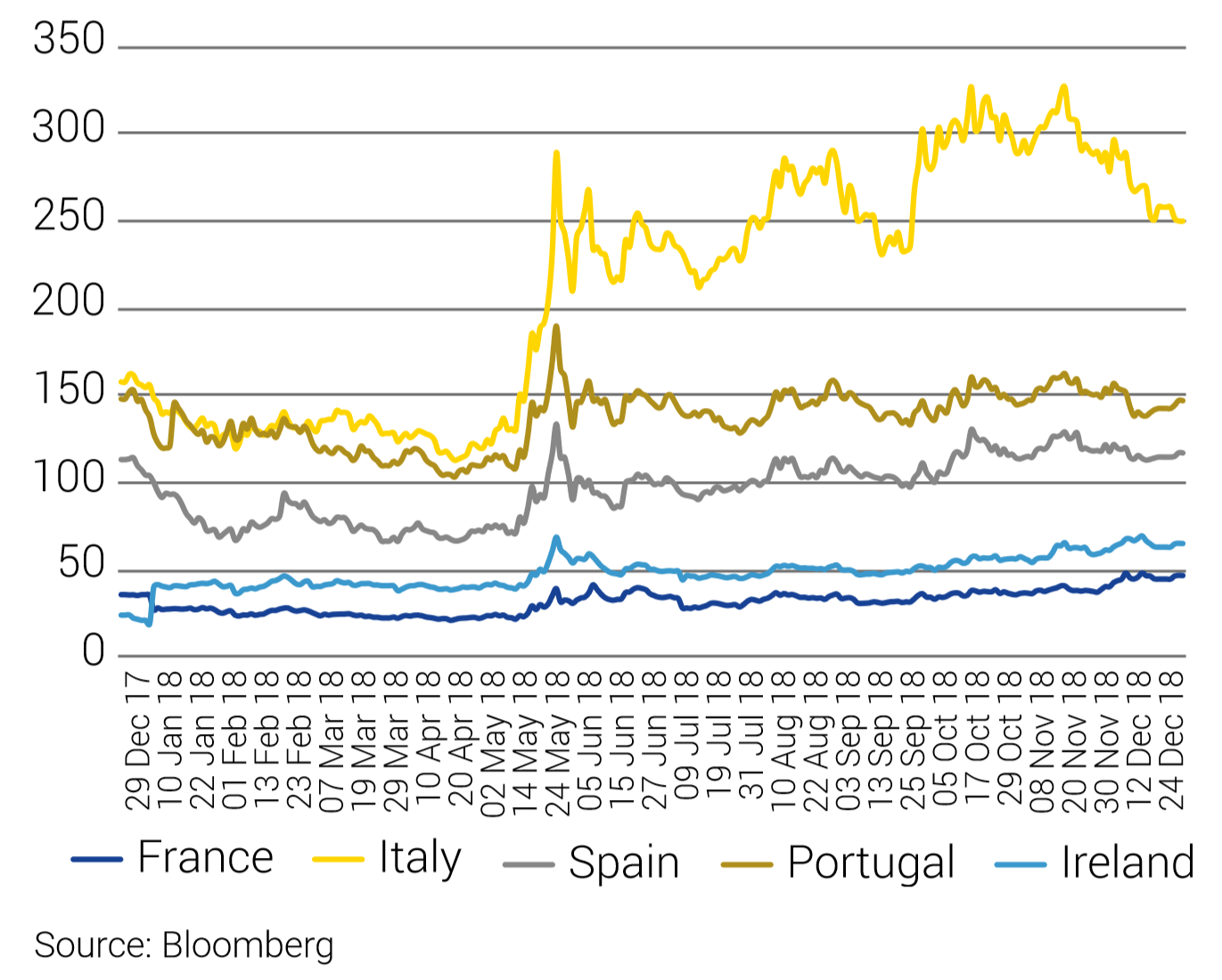

The ECB’s monetary policy normalisation, by tapering its net asset purchases, proceeded smoothly in 2018, but the global slowdown and US Federal Reserve’s dovish monetary policy response led markets to expect a more cautious monetary policy tightening from the ECB going forward after it announced a new series of targeted longer-term refinancing operations. While the euro weakened and German bund yields declined (Figure 10), sovereign credit spreads (Figure 11) widened to various degrees across the euro area. Market volatility resurfaced, fuelled by idiosyncratic risks, such as Brexit and policy uncertainty in Italy, but these challenges remained contained and did not become systemic. Against this backdrop, countries that had previously undertaken adjustment programmes remained resilient and retained stable market access. For more information on this topic, see ‘Resilience of ex-programme countries and limited contagion’.

Figure 10: German bond yields and the euro exchange rate

Figure 11: 10-year sovereign credit spreads of selected euro area member states vs Germany

(in basis points)

(in basis points)

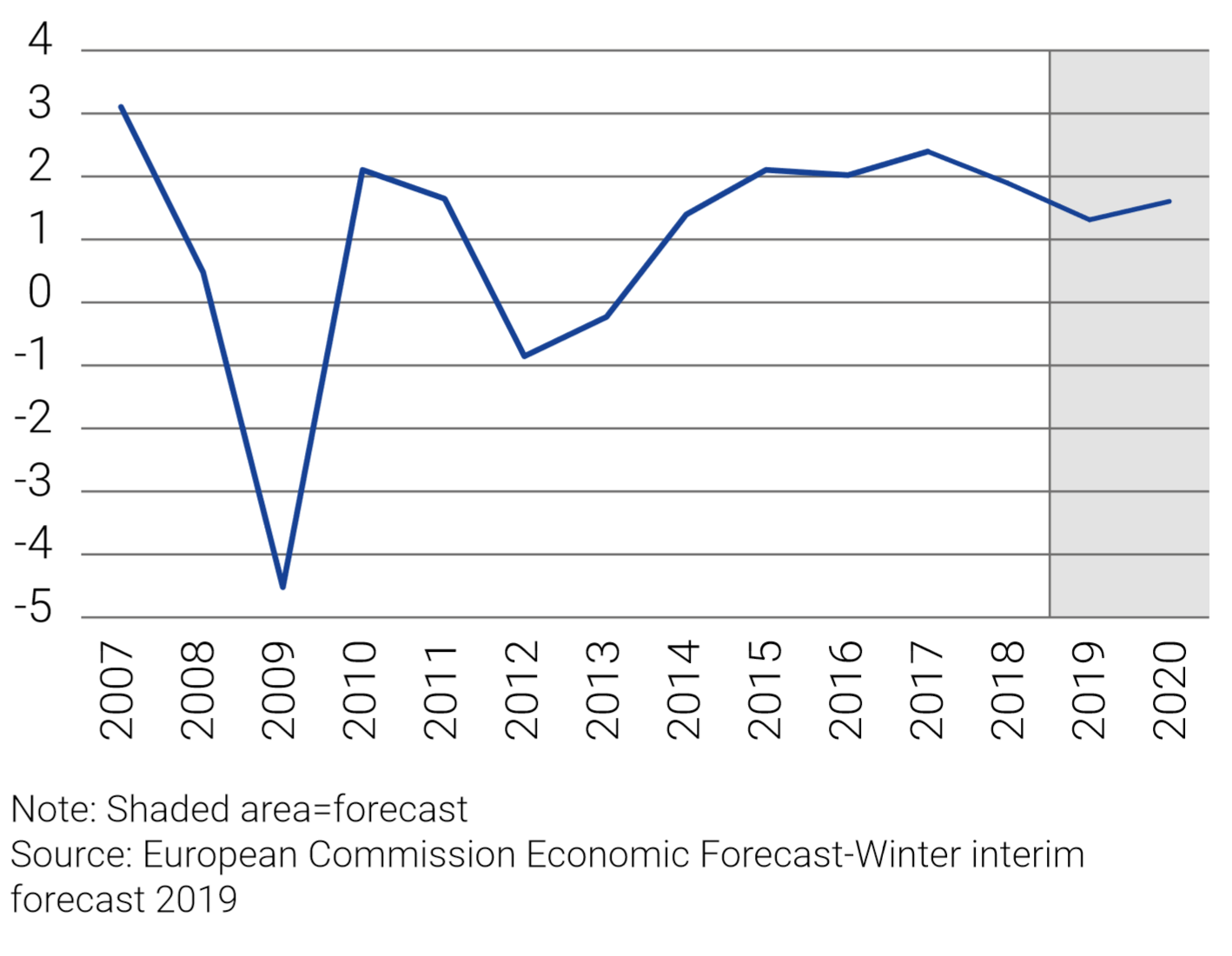

Euro area heads towards a soft landing in line with a maturing global cycle

The euro area is expected to lose some momentum in line with global trade and output trends (Figure 12), but fundamentals should sustain domestic demand, cushioning somewhat the effects of the global trade slowdown. The ECB’s still accommodative monetary policy, the potential use of fiscal stimulus by countries with fiscal space, the strong labour market conditions in some countries, and wage acceleration could strengthen domestic demand in the coming period. Still, labour market shortages could cap euro area growth. Moreover, increases in compensation per employee may pose challenges for countries with low productivity gains, as post-crisis competitiveness gains may erode. Overall, therefore, risks to the euro area growth outlook have moved to the downside. Uncertainties relate to global trade disputes, Brexit negotiations, the possibility of a US slowdown, and other political risks.

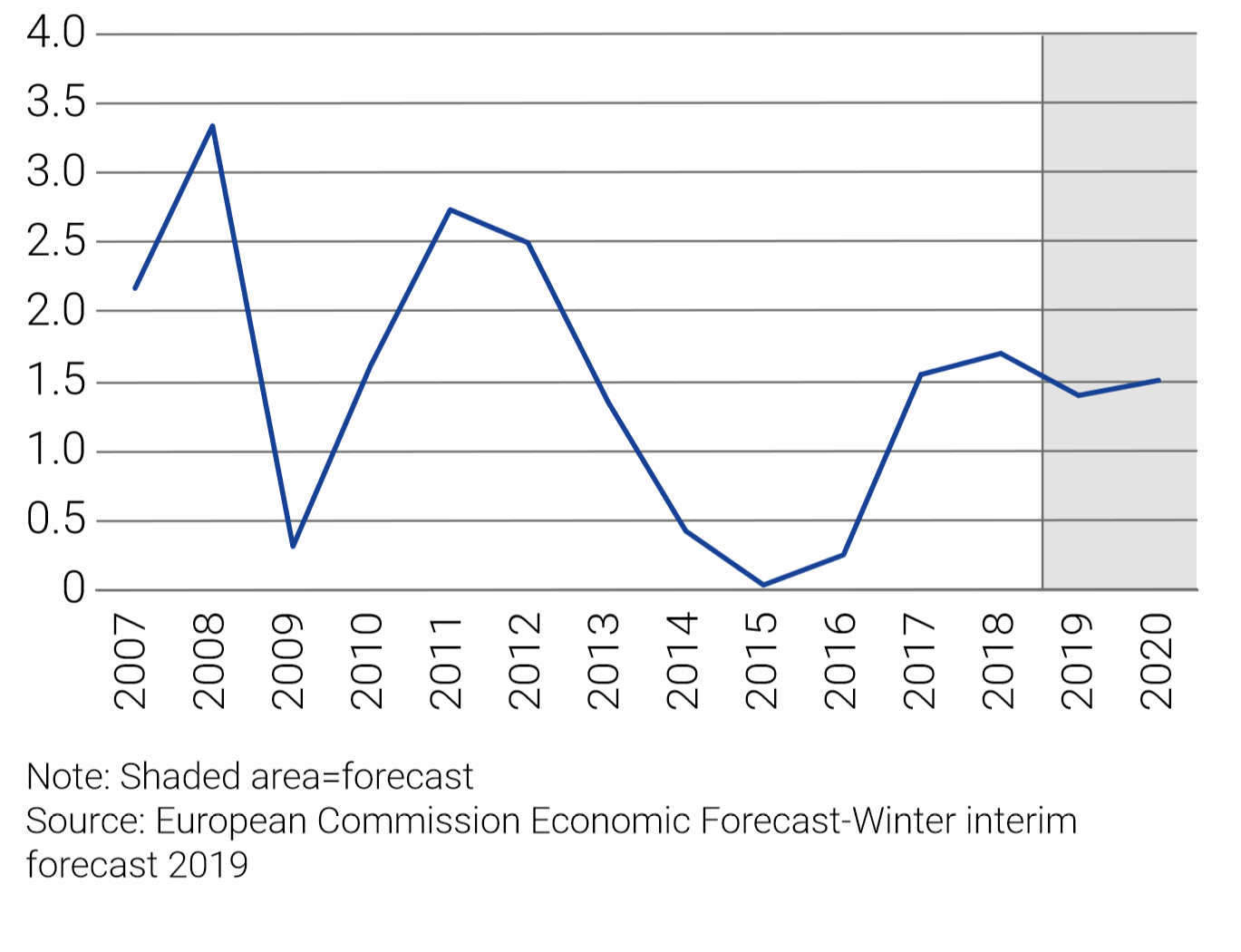

Figure 12: Euro area real gross domestic product growth forecast

(in %)

(in %)

The outlook for inflation also shows risks to the downside. The capacity of corporates to pass higher energy and wage input costs to final consumer prices is diminishing. The latest oil price decline, together with the global slowdown and the low pass-through of wages to final prices, increased downside risks for inflation looking forward (Figure 13).

Figure 13: Euro area inflation forecast

(in %)

(in %)

While the US Federal Reserve paused its tightening cycle, monetary policy normalisation in Europe is expected to continue at a very gradual pace. In the first half of 2019, markets focused on the ECB’s new series of targeted longer-term refinancing operations, and subsequently attention may shift to the outlook for policy rates. Liquidity provision and the potential for new monetary policy tools may also come under market scrutiny. Against this backdrop, sovereign credit spreads will most likely be driven by country-specific factors, including markets’ perception of political risks. Nevertheless, progress on EMU deepening can mitigate the risk of unwarranted financial market volatility.