The euro area economy: Resilience in uncertain times - speech by Pilar Castrillo

Pilar Castrillo, ESM Acting Head of Economic and Market Analysis

“The euro area economy: Resilience in uncertain times”

Barcelona, 13 June 2023

(Please check against delivery)

Good afternoon,

Today I will speak about uncertainty and resilience.

In uncertain times, building up resilience is a priority for people, firms, investors, and governments.

We are in uncertain times now.

The euro area economy has proven resilient while going through two unprecedented shocks: the pandemic and the effects of the war in Ukraine.

But risks and challenges persist, so we need to stay alert.

In the next 20 minutes, I will share with you how the euro area economy has overcome these two recent shocks and what challenges and uncertainties lie ahead of us.

I will argue that strengthening economic resilience will require speeding up and completing the institutional architecture of the monetary union, and prioritising investments and reforms.

The euro area economy was confronted with a double shock…

After several years of stable growth, with low inflation and low interest rates, the two shocks – in 2020 and in 2022 – changed the economic landscape.

One shock followed the other.

Both were external, unexpected, and unprecedented.

And each of them had the potential to damage the economy in significant and lasting ways, reminding us of the stagflation in the 70’s.

Even though we do not know what lies ahead, looking at the economy now, with the benefit of hindsight, we know that we managed to avoid the worst.

The economy was able to recover from the pandemic and was not derailed by the energy price shock, as much as initially feared.

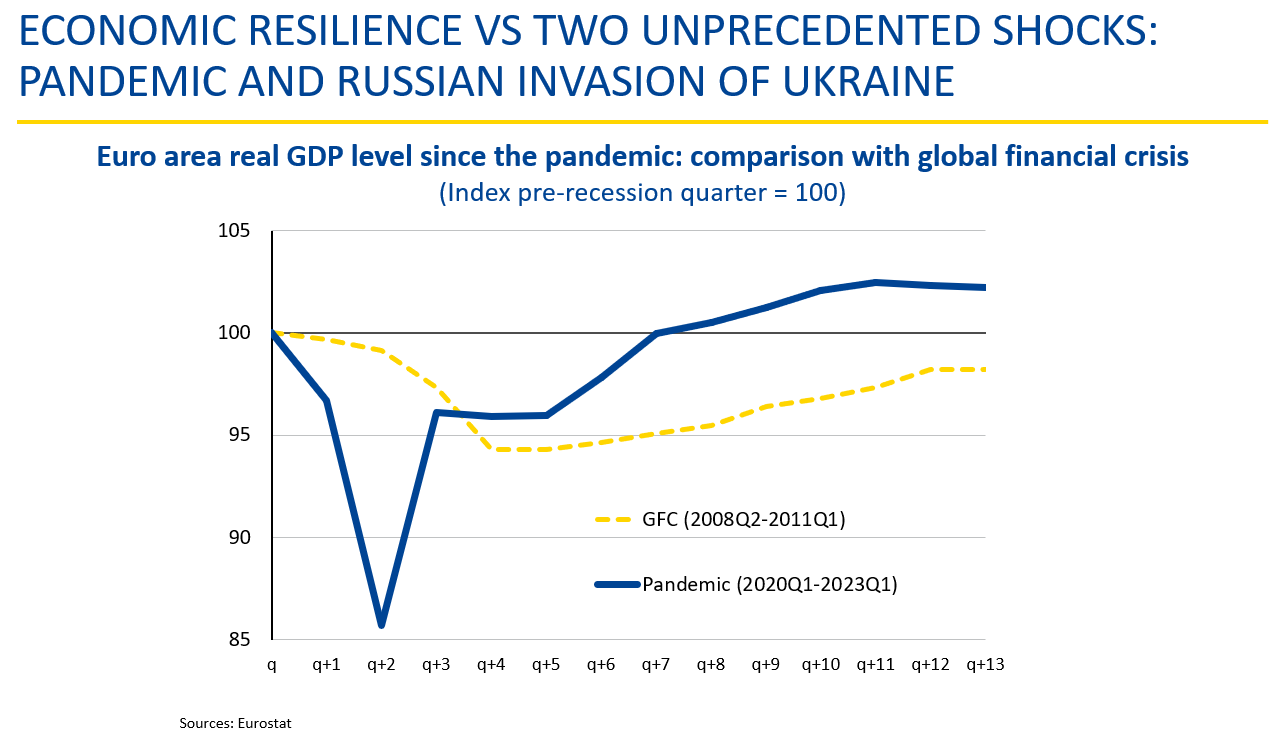

After only three years, euro area economic activity is already above its pre-pandemic level; while it took almost seven years to come back to pre-crisis levels after the Global Financial Crisis in 2008.

How can we explain this stronger resilience?

First, past work has paid off.

Following the crisis, countries implemented reforms and reduced their economic imbalances.

At the same time, the institutional architecture of the monetary union and its crisis management were strengthened, with the creation of the crisis fund European Stability Mechanism, and the start of banking union.

That is why we were able to face the recent shocks much better than a decade ago, both economically and institutionally.

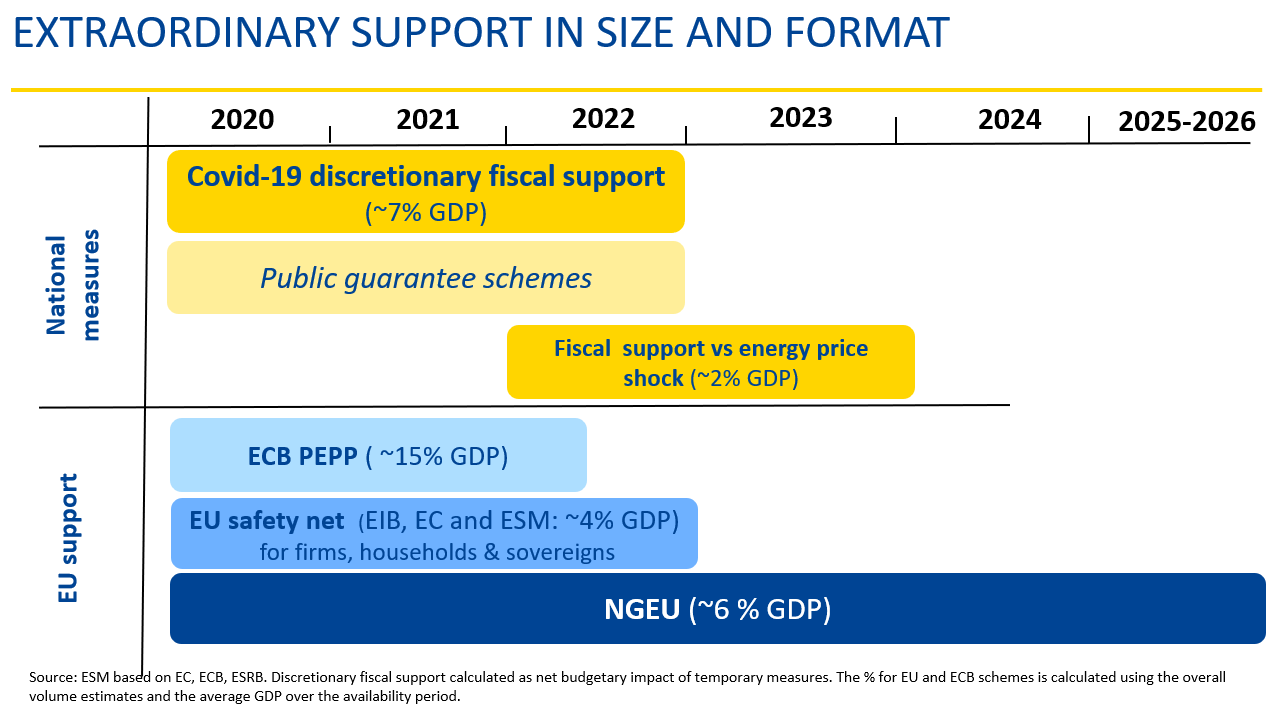

Second, there was an adequate and well-coordinated policy response.

At both national and European level, the response was agile, well-coordinated and significant.

The wide use of job retention schemes by Member States was key to preserving employment and avoiding long-term economic scars.

While at the European level, the €800 billion Next Generation EU fund was an important step towards deeper EU integration, helping economies recover from the pandemic while supporting the green and digital transition.

After global energy prices surged following the Russian invasion of Ukraine, governments also reacted swiftly with fiscal support – complemented by effective actions at the European level, such as filling-up storage capacity and reducing gas consumption.

Thanks to these policy actions, jobs and incomes were preserved.

…but legacy issues remain…

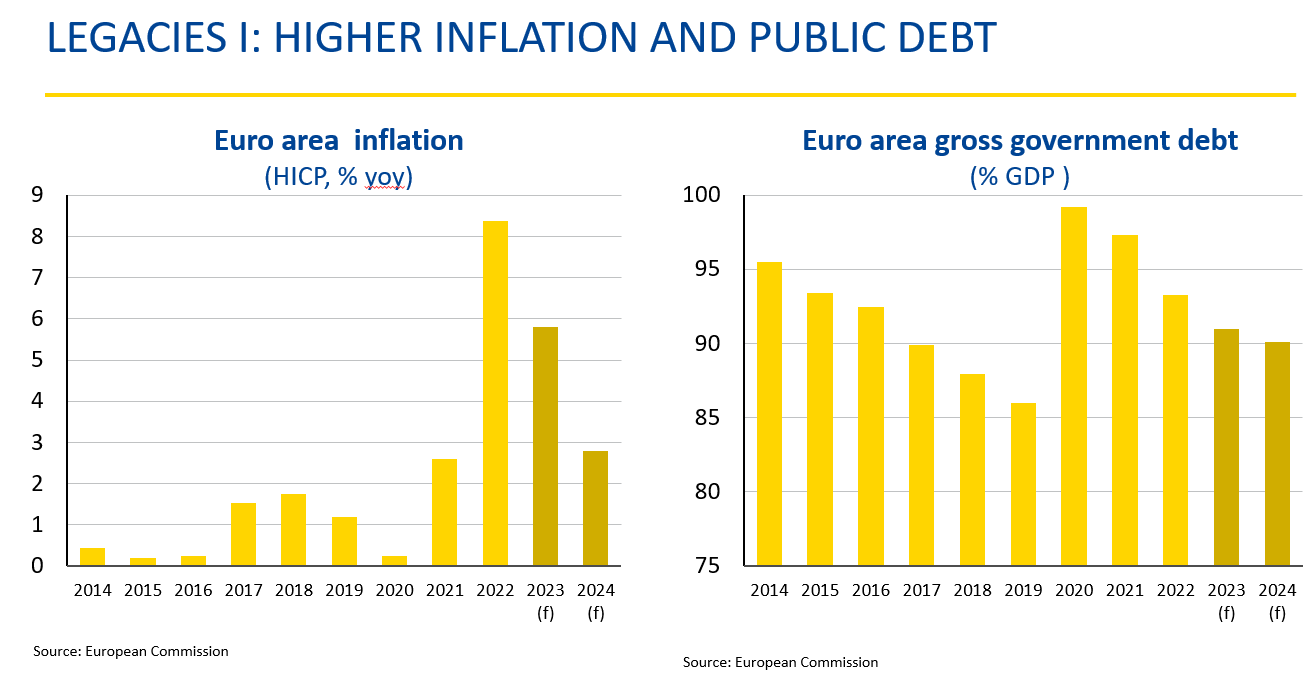

The double shock also had undesired consequences that have gripped European economies.

It led to an unprecedented surge in inflation.

And required sharp increases in interest rates, and higher public debt levels, as governments stepped in and increased spending to shield businesses and households.

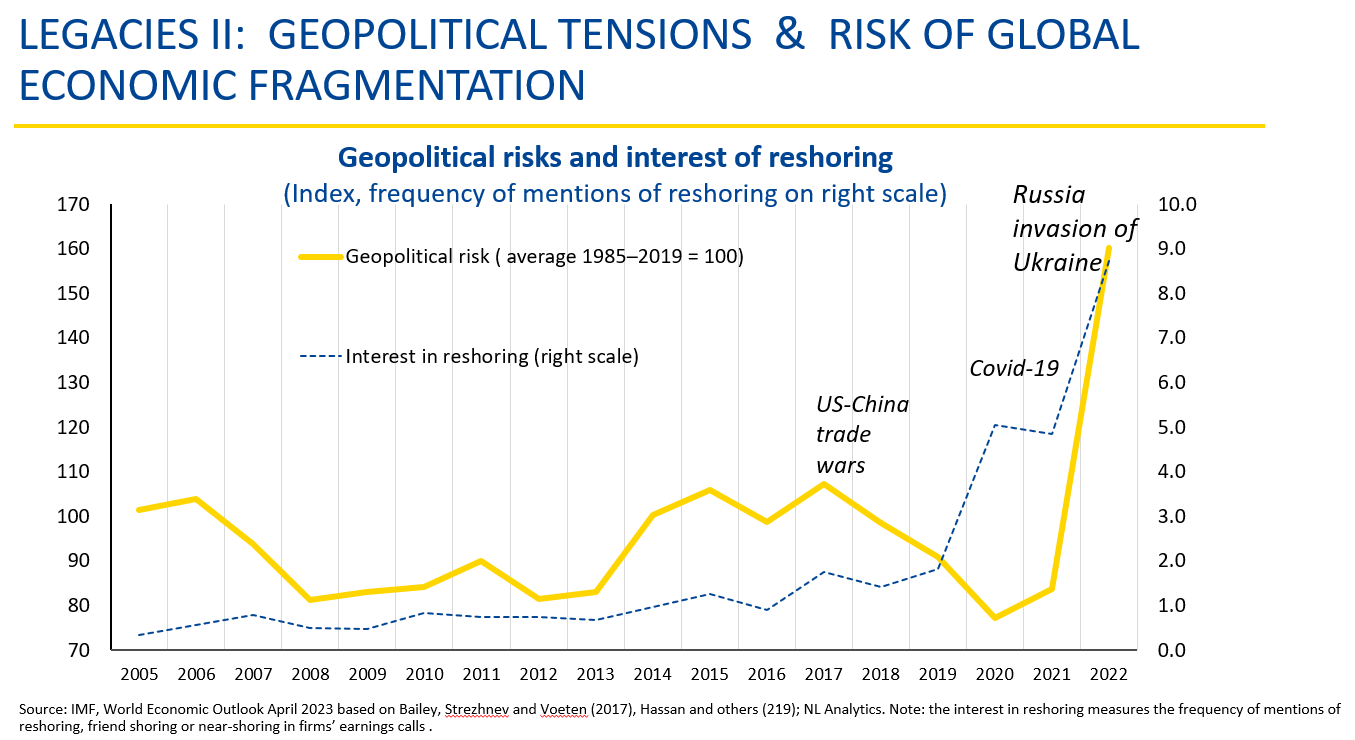

The two shocks have also left their marks on the global economic environment.

The slowdown in globalisation is not new, but the pandemic and Russian aggression against Ukraine have exposed the vulnerabilities of a world with highly interconnected trade and capital flows.

And geopolitical tensions have increased.

It becomes evident that in the coming years, the aftermath of the recent shocks will bring new challenges.

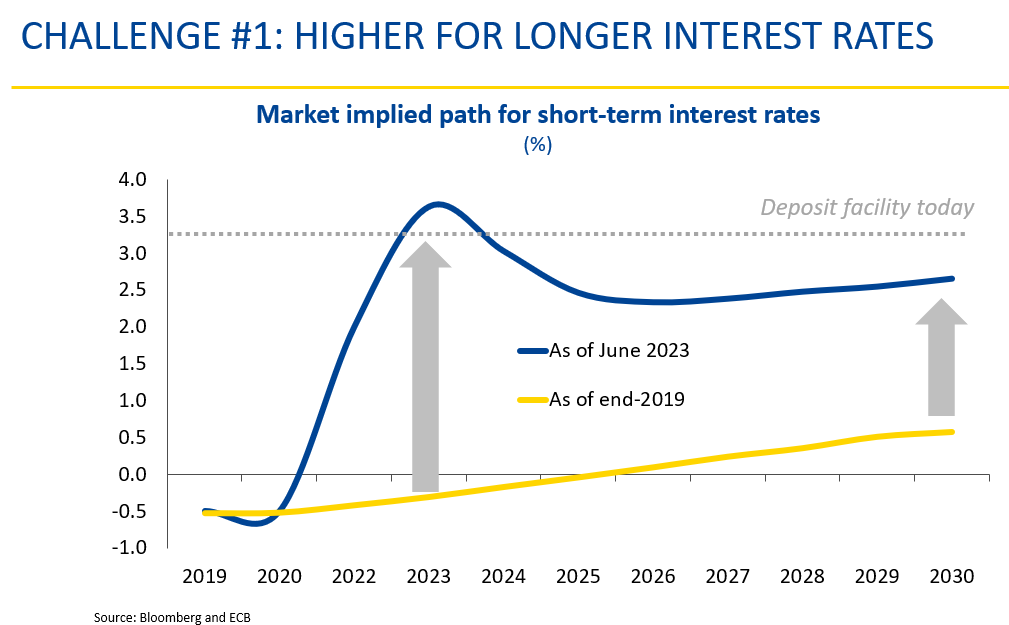

The first and most immediate challenge is high inflation and rising interest rates.

This has implications for growth and financial stability – a topic that is at the heart of the euro rescue fund ESM.

In response to elevated inflation, central banks from all over the world have increased interest rates at an extraordinarily fast pace.

Since July 2022, the European Central Bank’s (ECB) policy rates have increased by 375 bps, the strongest rise in the history of the euro area.

This change in monetary policy contrasts with pre-pandemic years, which were characterised by historically low interest rates and the expectation of a “low for longer” scenario.

Despite this significant change, the economy, financial markets, and the financial sector have remained resilient so far.

While these developments are encouraging, one needs to be cautious, as risks to the economy and financial stability from higher rates should not be underestimated.

First, interest rates have not peaked yet. And although inflation has started its downward trend, the pace of the eventual decrease towards the ECB target is uncertain.

This means that further rate rises might still be necessary, and rates may remain elevated for longer than what markets currently expect.

Second, we will only see the full impact of the interest rate hikes on the economy with a time lag, that can be of around a year or more.

Both the impact and the lag are subject to uncertainty.

And they depend not only on the magnitude of rate increases, but also on the degree of financial vulnerabilities accumulated by households, firms, sovereigns, and the financial sector.

They can either amplify or mitigate the initial shock.

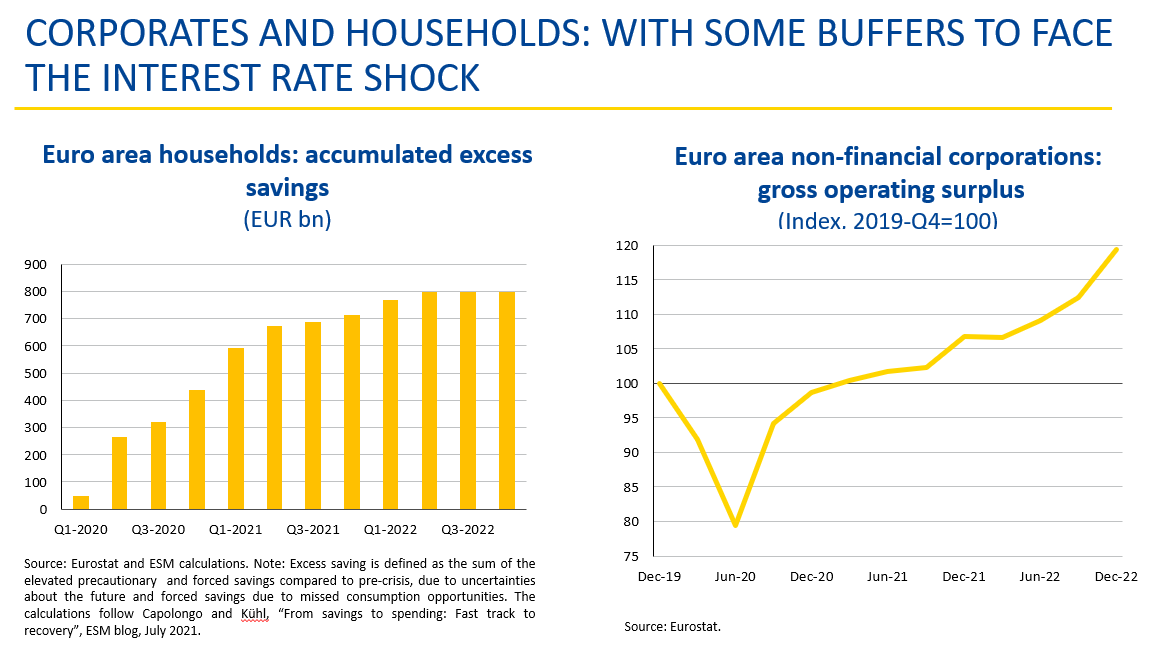

On a positive note, households and firms are facing this challenging period of rising interest rates in a relatively resilient position.

Both recovered fast from the initial shock of the pandemic, benefited from fiscal support, and were able to build some buffers.

In the case of households, these buffers stem mainly from a strong labour market and the savings accumulated during the pandemic.

In the case of firms, the recent increase of profits and profit margins also contributed to improvements in their financial positions.1

Of course, this is a generic description.

Not all households and firms are economically on the same footing.

That is why targeted support will still be necessary to protect some sectors.

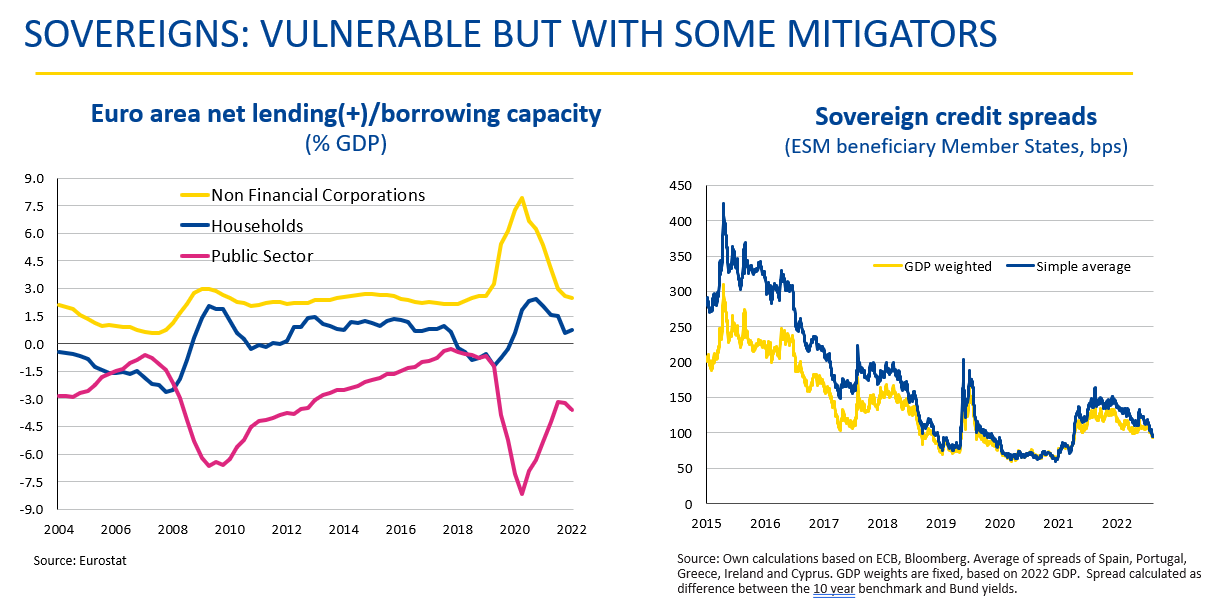

In contrast, sovereigns face the future challenges from a more vulnerable position.

By providing fiscal support, governments acted as “shock absorbers” during the pandemic and the energy crisis.

Consequently, they exited from both episodes with higher debt levels and less fiscal space to support the economy in the future.

Higher interest rates will have a lasting impact on government debt financing costs.

It takes around eight years in the euro area, for higher market rates to fully translate into a higher interest burden for governments.

This time-lag cuts both ways: it mitigates the immediate interest-rate shock to some extent, which is good news.

But it also means that higher interest will affect government budgets for quite some time and will not be a short-term phenomenon.

In the longer future, further expenditure pressures will also come from ageing population and the rise in investment needs related to climate, digitalisation, and the military.

Sovereign credit spreads have remained contained so far but might be vulnerable to rising interest rates and increasing financing needs, particularly in those countries with higher debt levels and shorter maturities.

The newly created ECB’s Transmission Protection Instrument should mitigate market access problems and fragmentation risks not driven by fundamentals.

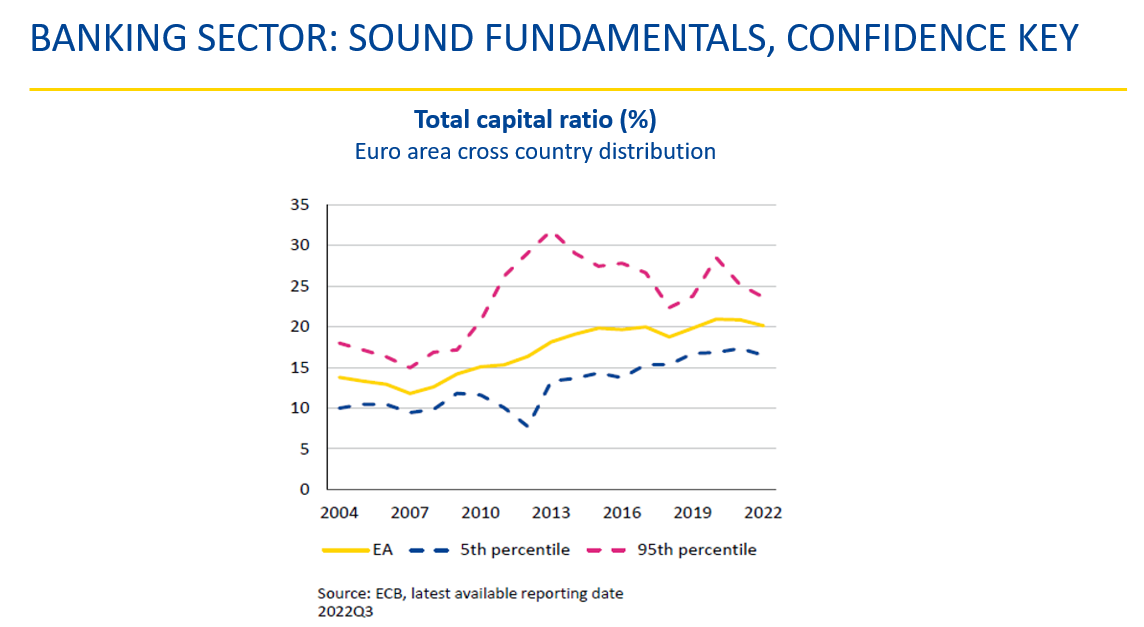

The financial sector, and in particular European banks, the main source of financing for the real economy, hold robust capital and liquidity positions, with a moderate deterioration in asset quality expected in the coming quarters.

However, recent stress episodes highlight how a fast-paced tightening of monetary policy can cause disruptions in the financial sector and markets, if there is a loss of confidence, and ultimately spill over to the real economy.

To summarise, the transmission of higher interest rates to the economy is so far proceeding with limited turbulences, given the unprecedented magnitude of recent rate hikes.

But uncertainty and risks are significant, and the resilience of households, firms, sovereigns, and the financial sector will be tested again.

So, although vulnerabilities look manageable, we cannot exclude unexpected risks from materialising and dragging the economy into a vicious cycle.

Dealing with higher interest rates is the first most immediate challenge.

The second challenge, with a more medium-term focus, relates to the sustainability of the euro area growth model in a new global environment.

With the pandemic and the energy shock, the future of globalisation is more uncertain and geopolitical tensions have increased.

And the euro area is particularly vulnerable to these developments.

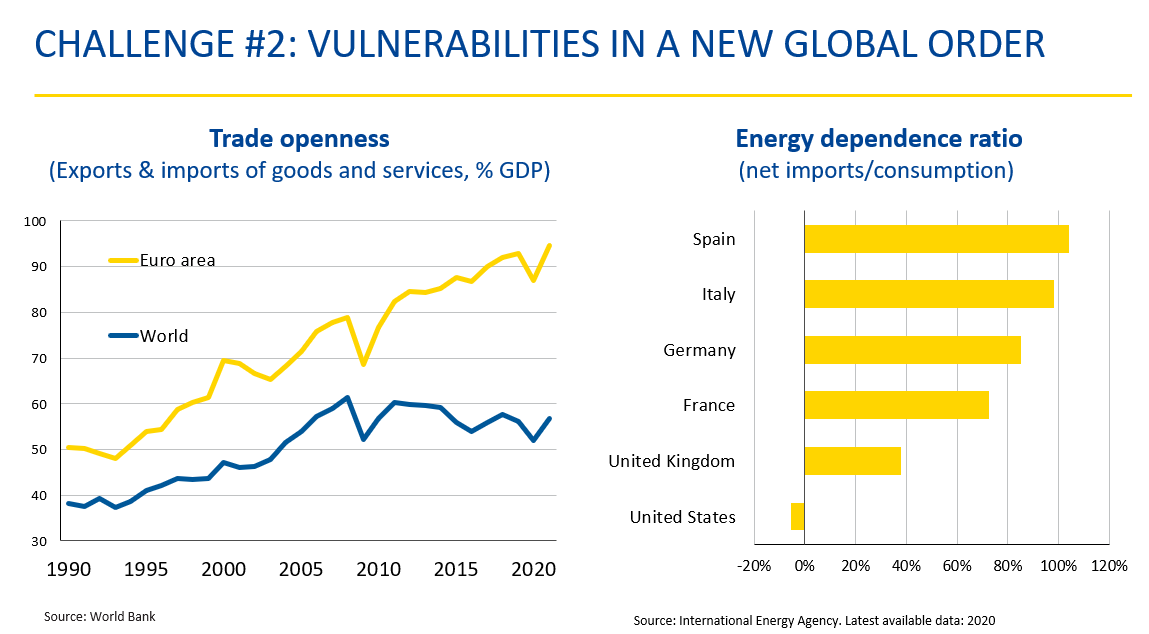

First, the euro area is more integrated into global trade, global value chains and financial markets than other major economies.

Trade openness of the euro area, measured as the sum of exports and imports of goods and services, increased sharply in the last decade, and it is now, at 94% GDP, almost twice the world’s average level.

And it is also more financially more interconnected than the US and China.2

Therefore, a trend towards lower trade and financial integration will be particularly negative for Europe.

Second, the euro area is more dependent on energy imports than other economies.

This dependence is most pronounced for fossil fuels (oil and gas), where more than 90% of the total amount consumed is imported.

As we have experienced recently, this dependence comes with a significant cost, because it can be misused – politically and economically – in times of geopolitical tensions.

There is a similarly strong degree of dependency for so called “critical raw materials”,3 needed for the development of technologies in the net-zero industry and digitalisation and produced by a small number of countries globally.

Given that demand for these products is increasing, supply disruptions can emerge.

Another, even bigger challenge, comes from technological dependency and the risk of technological supremacy of other countries, which may threaten our economic and financial resilience in the future.

It is no coincidence that the security of supplies and strategic independence have emerged as top priorities of businesses and governments.

Managing better Europe’s relationships and dependencies will become crucial.

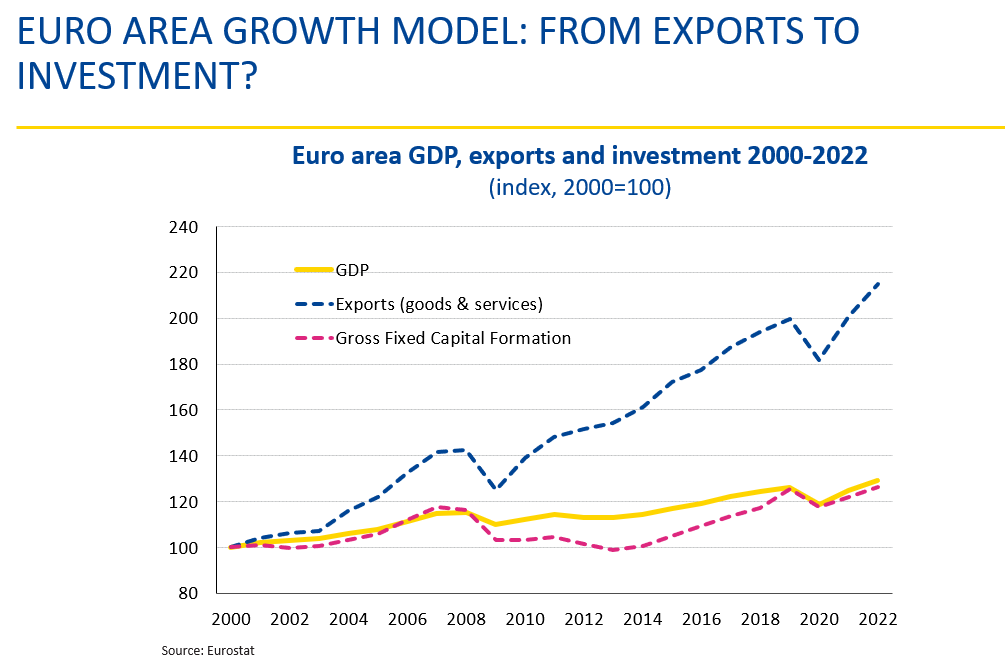

In the past, euro area economic growth relied on the external sector as one of its driving forces.

Given the more uncertain prospects for global trade, the need to strengthen domestic demand, and boost investment to ensure resilience has become much more urgent than before.

Let me conclude, ensuring resilience remains a priority.

With this objective in mind, I would make two final remarks.

First, the current institutional framework is strong, but it is still not complete.

Improvements in the European institutional framework have been key to overcoming the past two shocks and facing the ongoing monetary policy tightening from a more robust position.

But risks to the economy and financial stability are evident, and the next crisis could come at any time.

To address such risks, our next steps should be the completion of banking union and capital markets union.

Here the ESM plays an important role as part of the European setting.

In the context of banking union, the most immediate step would be the ratification of the amended ESM Treaty, which would empower the institution to act as a common backstop to the Single Resolution Fund.

The capital markets union, with the development of a common market for financial services, will help to improve risk-sharing and achieve a better allocation of capital across the euro area.

Furthermore, a resilient euro area requires a fiscal framework that is effective and adapted to the contemporary economic environment that safeguards the principles of sound, fit-for-future fiscal management.

In this regard, an agreement on the redesigned economic governance framework is of key importance.

Second, we need to find new ways to foster growth, competitiveness, and sustainability, while at the same time reducing external dependencies.

A rebalancing towards a more prominent role of investments in the green and digital transition should be the way forward.

This will contribute to modernising our economies, reducing external dependencies, and fostering sustainable growth.

But fiscal space is limited in many member states, and public investment alone will not be enough.

A successful transition also requires structural reforms and an ecosystem that supports private investments.

The use of the NGEU funds and the investments and reforms of the Resilience and Recovery Plans can be a game changer if they are implemented efficiently.

Finally, further progress on the mentioned banking union and capital markets union will help to diversify investment financing beyond conventional bank lending, the national budgets or the NGEU.

To conclude, investing in resilience today will help make the euro stronger tomorrow.

Thank you.

1 “Firms profits: cure or course” ESM blog, May 2023.

2 “The EU’s Open Strategic Autonomy from a central banking perspective” Challenges to the monetary policy landscape from a changing geopolitical environment. International Relations Committee Work stream on Open Strategic Autonomy. ECB, March 2023.

3 “Critical Raw Materials for Strategic Technologies and Sectors in the EU. A Foresight Study”. European Commission, September 2020.

Author

Contacts