The geopolitics of European financial markets - speech by Rolf Strauch

Rolf Strauch, ESM Chief Economist

“The geopolitics of European financial markets”

Pensions & Investments World Pension Summit

Online, 19 October 2020

Good afternoon. I would like to start with a brief overview of the current economic situation and outlook.

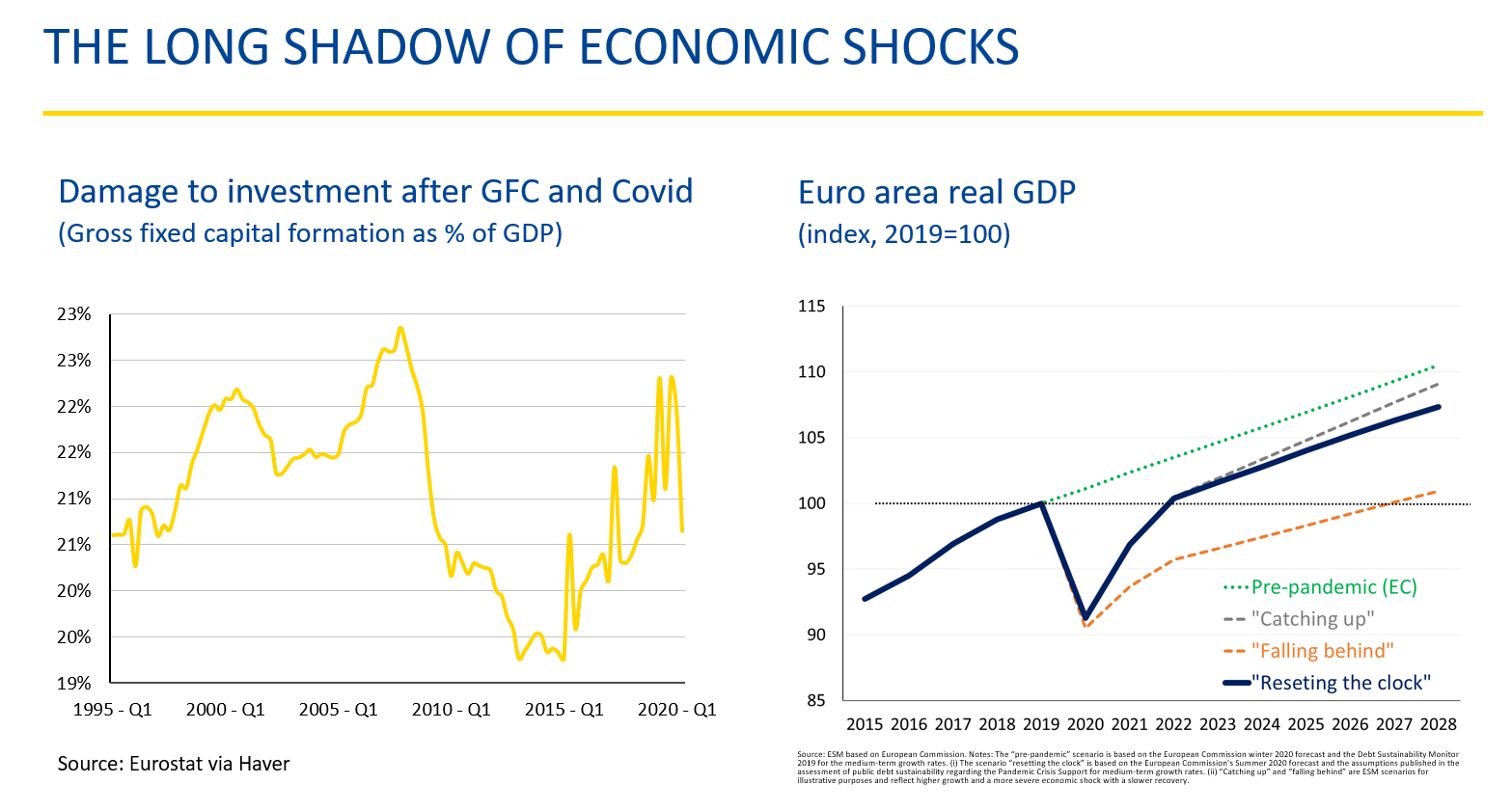

The European economy suffered a severe collapse due to the Covid-19 pandemic. The economic loss will be substantial, and only part of this will be recovered by 2021. In 2020, real GDP in the euro area will likely fall to levels last seen in 2014, with a recovery to 2016-2017 levels in 2021. There is a risk that investments might remain subdued well beyond the current shock, as we have seen following the financial crisis.

According to latest forecasts by the ECB, the OECD, the IMF and the European Commission, the loss in real GDP at the end of 2021 will amount to about €270-440 billion, a decline of between 2.4% and 4% compared to 2019.

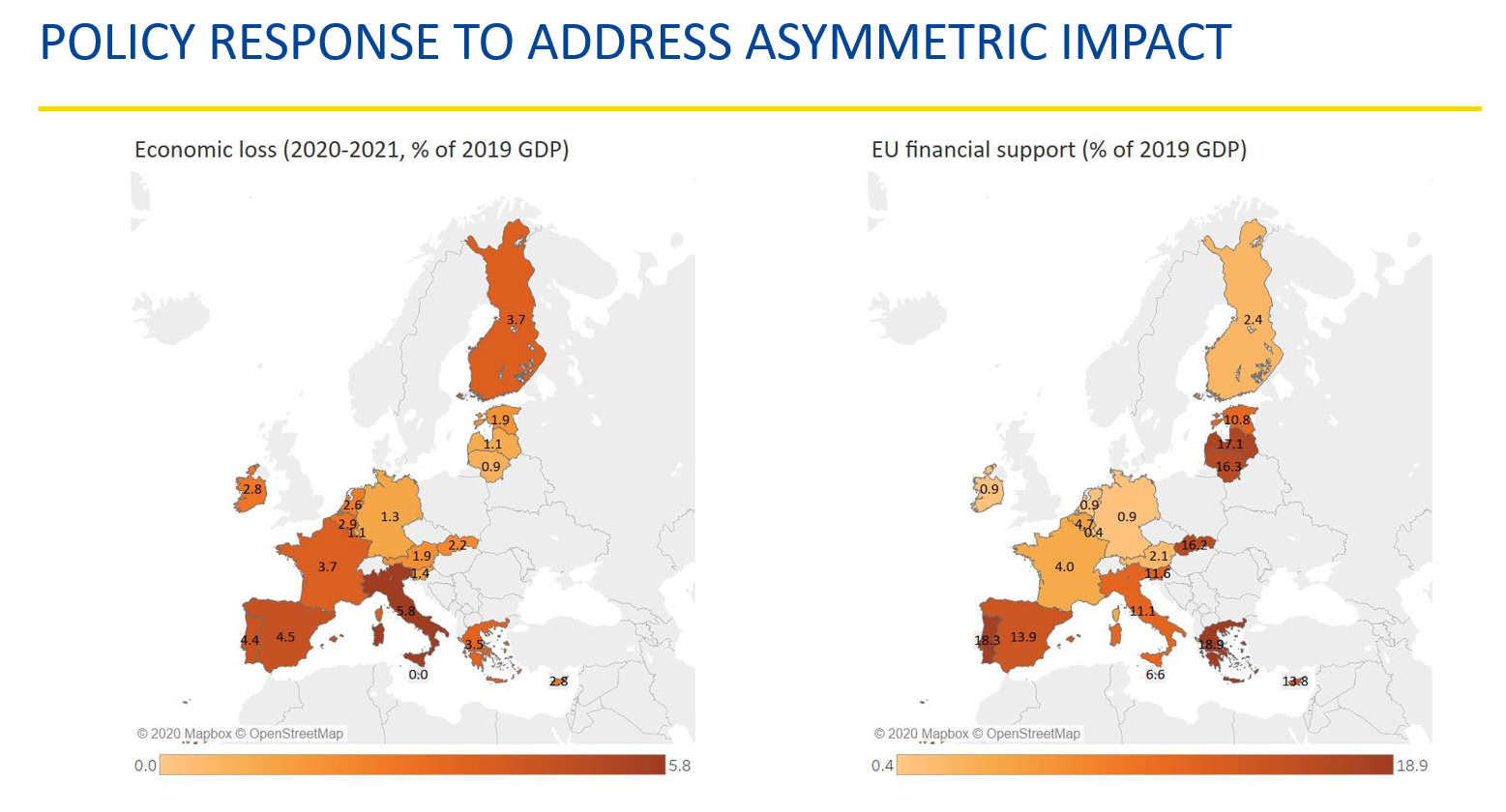

The unprecedented recession also adds to fiscal stress. The sheer volume of financial support for businesses and workers puts a strong on national budgets. Since member states have different fiscal space, the impact of the coronavirus adds to the risk of divergence within Europe.

To address such risks, Europe responded quickly to the pandemic with policy measures designed to help the most affected countries. At the beginning of April, euro area finance ministers agreed on three safety nets worth a total of €540 billion. One of those safety nets is the ESM’s Pandemic Crisis Support instrument, a credit line for governments to cover health-related expenses.

Furthermore, in July, the European Council adopted the €750 billion "Next Generation EU" recovery plan. This sends a strong political message, and it is a positive step economically, as it will encourage structural reforms and strengthen competitiveness in the euro member states.

Challenges

Nevertheless, the challenges beyond the pandemic remain considerable.

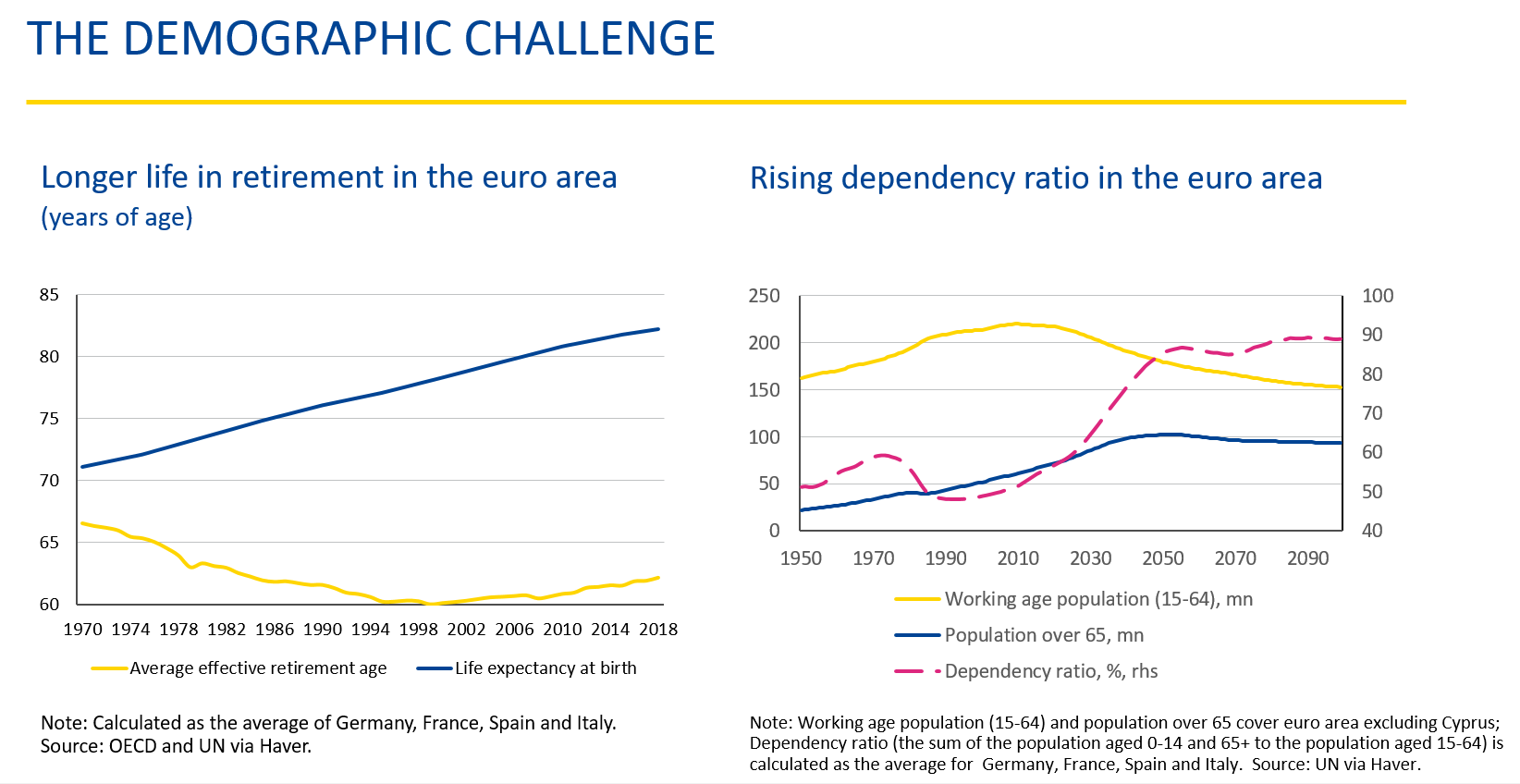

Demographics and low productivity have been weighing on Europe’s long-term growth prospects, which had already been subdued before the pandemic. Life expectancy has been growing steadily in the euro area over the past fifty years, but the average effective age of retirement had been decreasing until the late nineties. Although this trend has turned, we are still not back to where we were in 1970.

As the working population starts to shrink, while the population in retirement continues to increase, economic resilience and productivity growth will become all the more important. There will be an increase in pension liabilities and the cost of health and long-term care, associated with longer life expectancy.

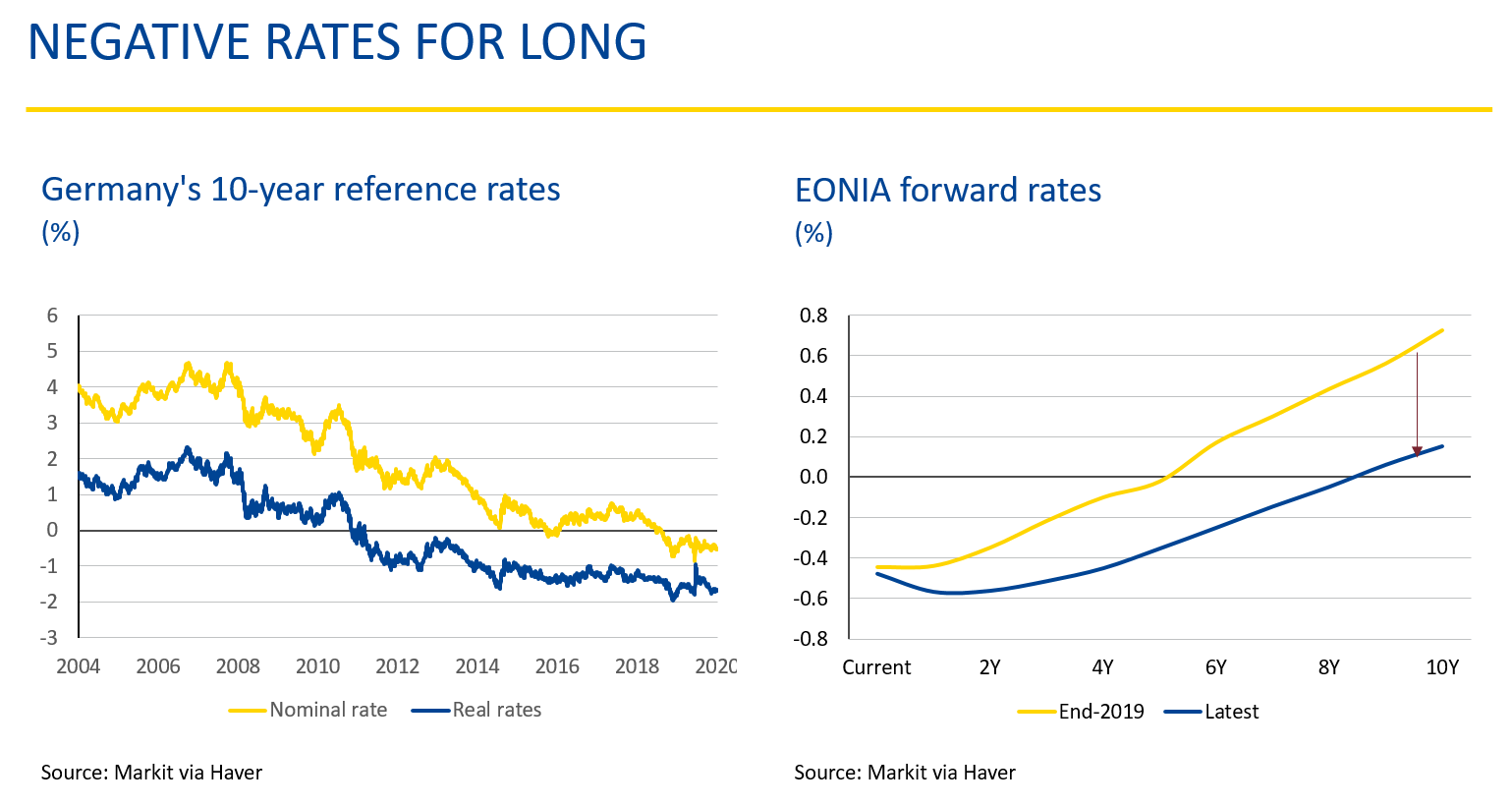

There appears to be a mounting consensus that demographics contributes to the low interest rate environment. The legacy of the financial crisis and the recent pandemic shock further exacerbated the “low for longer” environment. Low interest rates may help the recovery in the short run, but also entail significant risks in the long run – such as asset price bubbles, financing of inefficient firms and low growth. Low interest rates have led investors, including pension funds, to diversify their investments and take on more risk. This has benefits, but is important to effectively manage the increased risk exposure.

Turning to geopolitical challenges, the US-China-EU relationship is of paramount importance. Geostrategic rivalry between the China and US is likely to persist, regardless of the outcome of the elections in the US, which puts Europe in a difficult situation. We may have to ensure diversification in our trade relationships and possibly rethink the export-driven European model.

The geopolitical risks of climate change are now becoming evident. They include famine, mass migration, destruction of people and assets, and conflicts over scarce resources. These developments will become more frequent and severe over time. Pension funds, with their long-term perspective, should plan and be prepared for such shocks in the coming years.

The steps ahead

Major efforts have already been taken to strengthen the stability of the euro area and Europe. However, there are a number of ambitious projects in Europe that need to be completed or developed.

Completing banking union is an essential step. We must dismantle barriers to cross-border banking to promote a more integrated banking union. And Europe has to move towards a broader financial union. More integrated financial markets will be more resilient to external interference.

The capital markets union would help to create a deep and liquid market for euro-denominated assets, such as equities and other financial products. As part of this agenda, bankruptcy, tax and corporate laws need to be harmonised. This is a complex, but necessary, process that will eventually encourage cross-border investment and open up new ways to finance businesses.

Expanding the supply of European safe assets is an additional step towards integrating Europe’s financial markets. A European safe asset would allow Europe’s banks and pension funds to manage risks in their sovereign debt portfolio, and cement global investors’ confidence in the European project.

One area that is particularly important is ESG and green finance. Europe is in a strong position with a lead in green markets, and should consolidate its role as a standards-setter for ESG. There is a mounting expectation from investors that finance can help address climate change, and Europe should fulfil these expectations with the continued development of green finance.

Role of the financial sector

In addressing these challenges, there is an important role for the financial sector in general, and for pension funds in particular.

Complementing the bank-based European financial system with more diversified and flexible capital markets is a must. Although pension sectors are very different across European countries, the US capital market is bigger than in Europe as a whole because people invest more savings on the capital market.

If pension funds could see stronger demand, capital market size would increase in the euro area. Furthermore, the diversification of pension funds’ investments may help to foster the growth of European capital markets. An active pension sector can help in the efficient allocation of financial capital, and thereby stabilise and reinvigorate the European economy.

Conclusion

Europe is facing complex challenges in the near and long-term future. In my view, the pandemic crisis should be treated as an opportunity for a comprehensive upgrade of Europe’s potential. We need to boost productivity, innovation and investment, to make way for the green transition and digital transformation.

This requires coordinated and well-managed policies at national level and European level. The financial sector has an important role to play in the upgrade, and success will ultimately hinge on its capacity to adapt to long-term economic and demographic trends. Policymakers should ensure the best conditions for this adaptation to take place. Thank you.

Author

Contacts