The euro area in a globalised economy: an ESM perspective - speech by Rolf Strauch

The euro area in a globalised economy – an ESM perspective

BBVA European Debt Conference

New York, 4 October 2017

(Please check against delivery)

Ladies and gentlemen,

First of all I would like to thank BBVA for inviting me here to present the ESM’s perspective on the euro area.

The ESM was born as a result of the euro debt crisis. And over the past years, we’ve often heard the view in the U.S. that the euro area is the sick man of the world economy. That perception has fortunately changed now. This morning you have heard from some of the European economies, which have emerged stronger from the crisis. The strength of the global economy is an important driver of the robust recovery the euro area is now experiencing. I believe the fact that the euro area has left the crisis behind it also offers some interesting lessons on how to embrace globalization.

European countries have gone further in accepting globalisation than others. At the same time, we have found better ways to address its pitfalls. Our societies are more equitable. It provides greater solidarity to those left behind by globalisation. More people benefit from the upswing that we are now experiencing. Europe is also a great believer in multilateralism and cross-border coordination. During the euro debt crisis, it has made a massive contribution to the Global Financial Safety Net, the system to fight global financial crisis. And people recognize it: the popularity of the euro is at record highs.

Still, there is more work to be done. If the euro area wants to remain a successful actor on the global stage, it needs to continue to work to make monetary union more robust, and more resilient. This will be an important challenge for the political agenda in the near future, though I believe that the momentum now is very good.

In this speech, let me walk you through these issues. First, I will give you some evidence to show that Europe is the most globalised of the world’s large economies. In many respects it is a heavyweight, and has an outsized impact on the world economy.

Second, I will show how the euro area economy has benefited from this, and from the policy response that Europe put in place to fight the euro crisis. Monetary union has come out of the crisis stronger than before, institutionally and economically. It has also been better able to redress some of the adverse income effects of globalisation.

I will dedicate my remarks thirdly to pointing out some areas where the euro area could still improve. These will help Europe to stay an open and competitive economy benefitting from the world economy.

I. The euro area in a global economy.

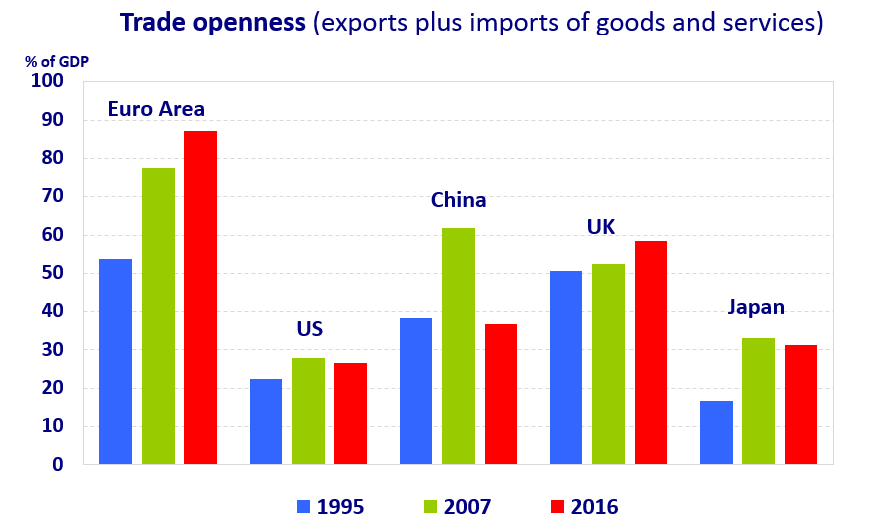

There are various ways to show the degree to which the euro area is integrated into the global economy, but in summary, it is fair to say that it is the most open major economy of the world. For instance, the euro area is the trading powerhouse of the global economy. The size of exports plus imports of goods and services expressed as a percentage of the total economy stood above 80% in 2016.

That is by far the biggest of any major economy. In the U.S., the percentage is only 25%, and in Japan it is roughly a third. In 1995, the ratio in Europe was only 50%, while it remained largely stable for the U.S. over the same period. So Europe has really strengthened its openness to trade, but the U.S. has not significantly. And while Japan has also increased its openness to trade in the past 20 years, it did so from a low basis, and has stalled since the global financial crisis.

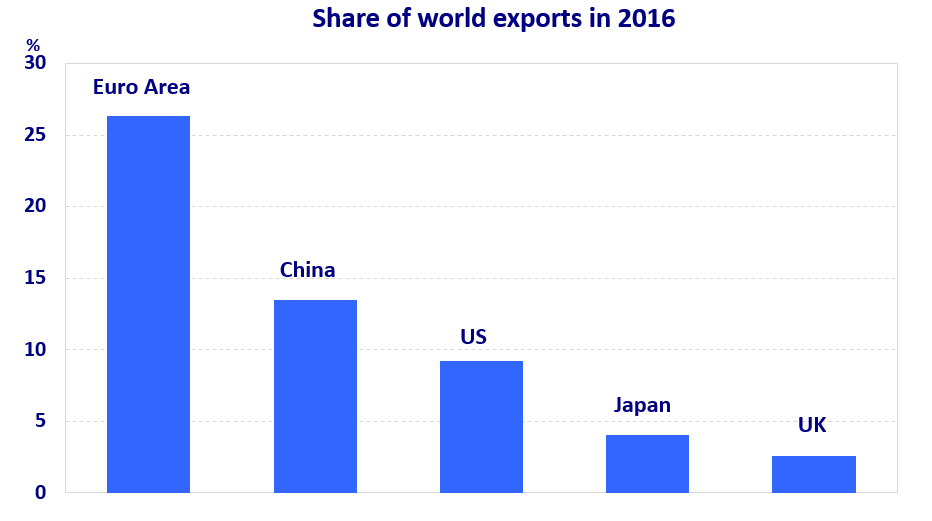

Another way to measure openness is by looking at the market share in global exports. This similarly shows the euro area’s importance in global trade. While the euro area only represents about 16% of global GDP, a full 25% of exports in the world originate in the 19 countries of the euro area. This is by far the highest share for any large economy in the world. And this is the case despite the rapid rise in recent years of fast-growing economies such as China, where the number stands at only 13%. Other economies trail far behind that, with the U.S. at 9%, and Japan at just 4%.

It is important to note that the euro area exploits the sectoral diversity of its economies. Its sectoral structure, and its export portfolio is extraordinarily diverse. Countries are specializing in different products. In other words, it’s not all about German cars! Italy and Portugal are strong in manufactured products, Ireland specializes in chemicals products, while Greece and Cyprus have a relatively high share of mineral fuels and related products.

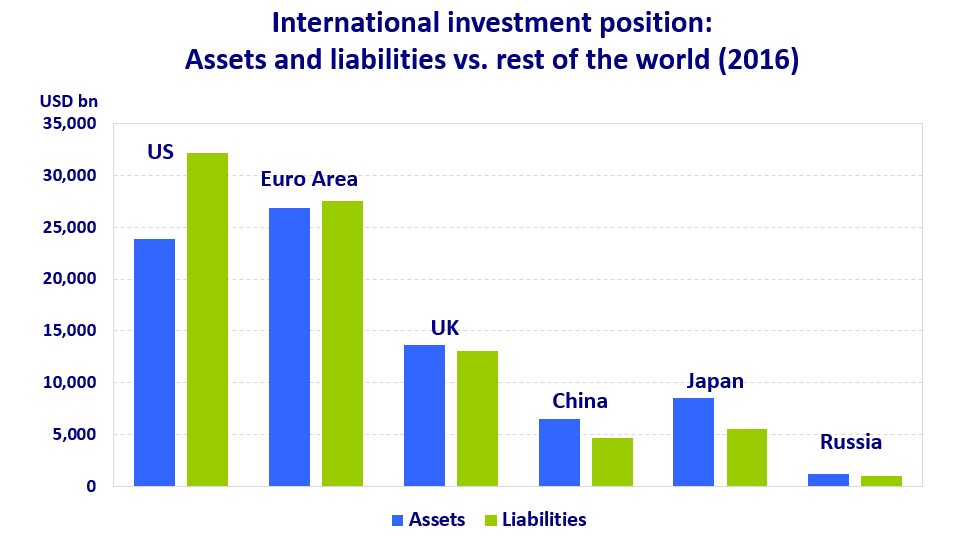

A third way to measure the euro area’s interconnectedness is by looking at financial market indicators. Here again, one sees that the euro area is a strong player. Looking at net international investments, the euro area has more assets vs. the rest of the world than any other peer

Similarly, interest on euro area assets (i.e., euro area liabilities vs. the rest of the world) is the second largest in the world very close to the US. Drilling down into the financial sector, it is more difficult to get comparable data. But it is fair to say that the euro area investment fund industry, together with the insurance market, hold about 27% of worldwide assets and more than 22% of gross premiums, respectively. Interestingly, euro area countries generally also exhibit a lower degree of home bias than Japan, the U.S. or the United Kingdom. The home bias in allocations of portfolios of stocks or debt securities is the lowest compared to the other economies. And the numbers are trending down.

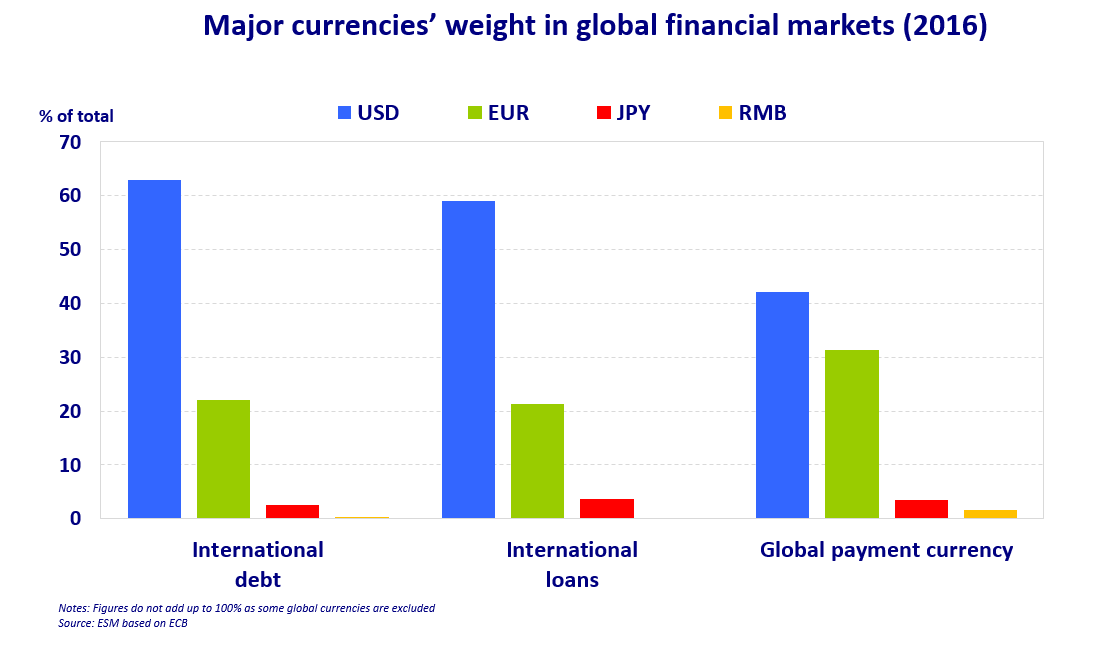

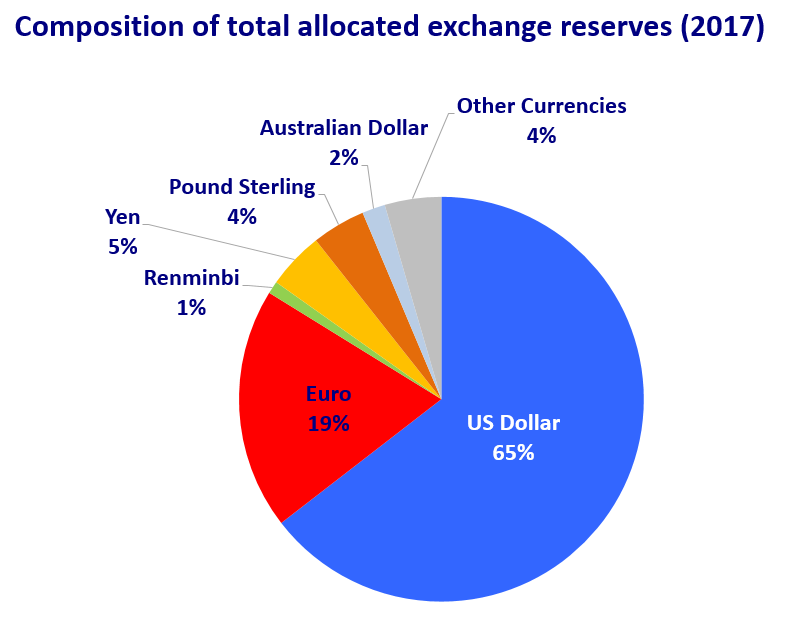

Finally, let’s take a look at the weight of the euro in international financial and currency markets. At the risk of sounding like a broken record, it again becomes clear that the euro area plays a central role.

As a global payment currency, the euro makes up 33% of the total market. More than 20 percent of international loans and international debt is denominated in euros. It is true that this is well below roughly 60% denominated in U.S. dollars, but again higher than the euro area’s relative weight in the global economy. The euro is also the second-most important international foreign exchange reserve currency, with a share of approximately 20%.

II. Euro area economic recovery, employment and income equality

The fact that the euro area continues to play such a strong role in the global economy, despite having experienced a deep recession, is the outcome of a set of far-reaching responses policymakers took over the past decade. These initiatives have helped to deepen integration, made the institutional infrastructure more robust, and the euro area economy more competitive.

The euro area experienced two serious financial crises in the past decade. First, the global financial crisis hit us like it did the rest of the world. It was essentially a credit bubble on the back of complex financial products. As you know, it originated in the subprime mortgage market in the U.S. And just as the U.S. started to recover, Europe was hit by a second crisis, which was entirely of our own making. A number of countries lost access to refinancing markets, as investors started to doubt that their fiscal positions were sustainable. It was something that had not be foreseen when monetary union was set up. Nobody believed that a country could risk default once it had entered monetary union. But this is precisely what happened. Without the remedial action that was taken, there was a very real risk that the euro could have fragmented.

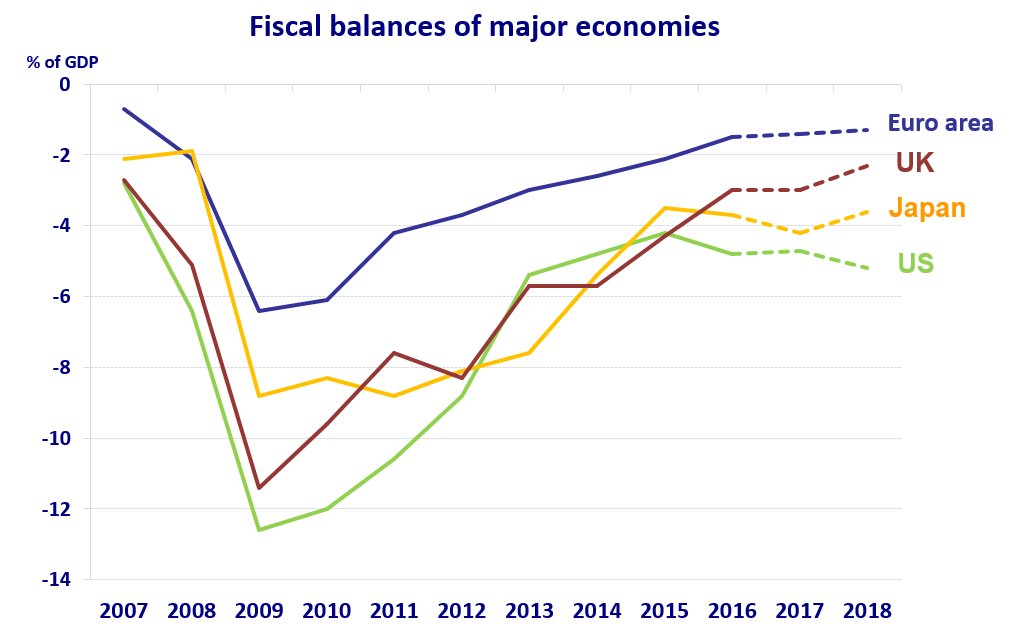

A break-up of the euro would have been an economic catastrophe, and so the euro area put up a spirited defence. In the first place, countries have worked hard to reduce the macroeconomic imbalances that were at the heart of the crisis. They continued a reform path they had started before. Fiscal deficits have now narrowed considerably. In the aggregate, the euro area public deficit is smaller than that of the U.S. or Japan.

These national policies were supported at the central level by a tightening of the fiscal rules, and through setting up the Macroeconomic Imbalances Procedure, which gives the European Commission the ability to take action if it sees a renewed build-up of the same macroeconomic imbalances as those that played a central role in causing the crisis.

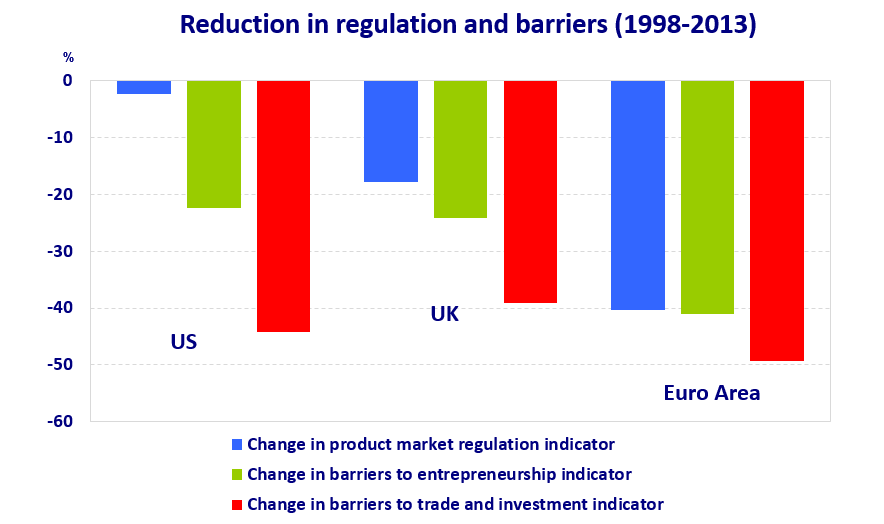

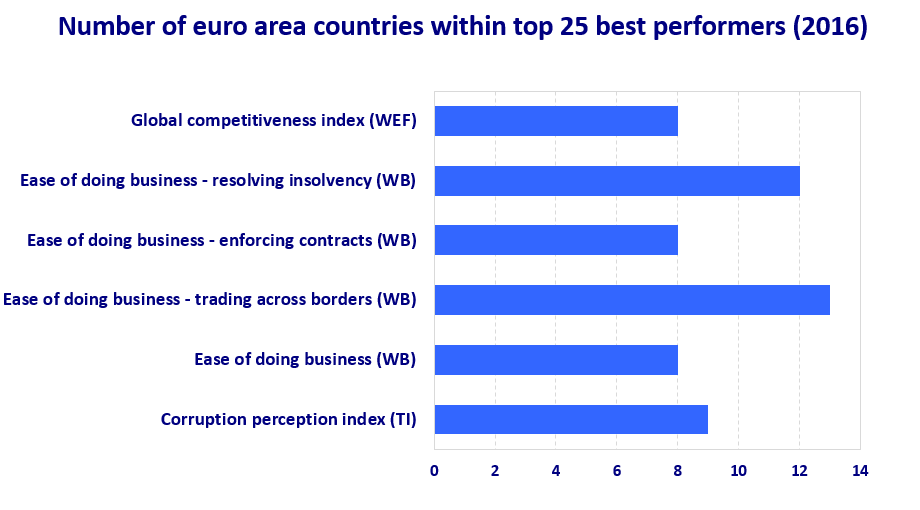

Euro area countries also liberalized their product markets and reduced barriers to entrepreneurship by more than, for example, the U.S. and Japan. As a consequence, euro area economies have among the most competitive business climate in the world

According to the World Economic Forum, one third of the most competitive 25 economies are located in the euro area. For certain aspects, such as insolvency law and trading, it is even about half of the top group.

Following the crisis, euro area economies showed a great deal of restraint in unit labour costs, which increased by less than half in the euro area compared to the U.S. This was another factor why they were able to reverse the loss in price competitiveness experienced during the first decade of EMU. The euro area CPI rose more than 10 percent in the period between 1999 and 2009. In the U.S. it dropped by 7%, while the UK saw a decrease of more than 20%. So, a euro area product might have become more than 30% more expensive than a similar product bought in the UK over that period. Fortunately, in the past seven years, this trend has reversed. Now, euro area price competitiveness has improved by more than 15 percent, while it has decreased 10% in the U.S. and 5% in the UK.

The euro area also - and I would say naturally - joined the G20 effort kicked off in 2009 to make the financial system safer in the wake of the global financial crisis. Europe put in place a single supervisor for its 130 most systemically important banks, the Single Supervisory Mechanism. We also now have the Single Resolution Mechanism, to wind down failing banks. These two pillars of what is known as the Banking Union constitute a transfer of national competences to the central level that would have been unthinkable a few years ago, and which are the basis for a common euro area banking market. It has made the sector much safer, together with the marked strengthening of balance sheets of the individual institutions.

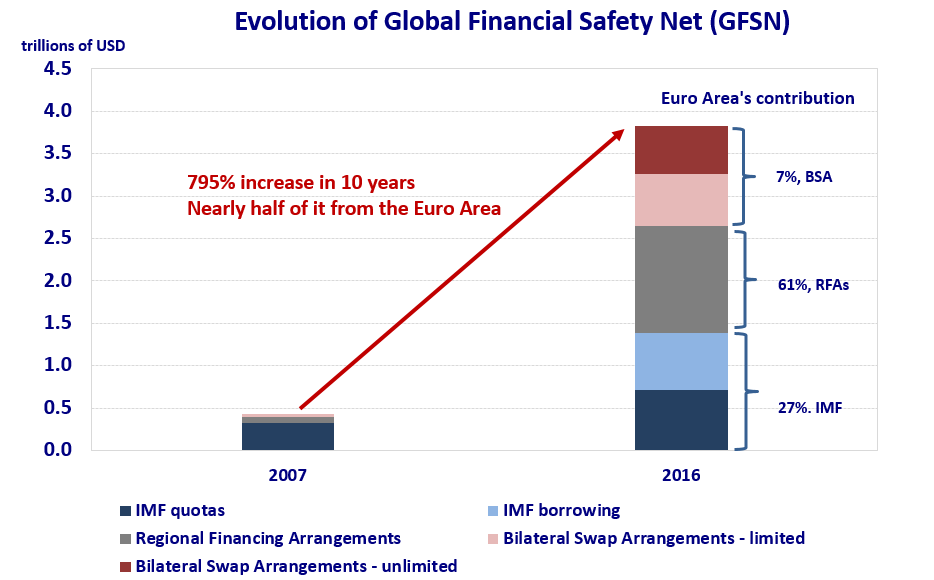

The unconventional monetary policy measures of the European Central Bank played an inestimable role to calm markets at the height of the crisis. The ECB was one of the major central banks issuing reserve currencies which established swap lines with other major economies to ensure the liquidity of the financial system. This was an important contribution of the euro area to the Global Financial Safety Net (GFSN), which consists of four layers: national currency reserves, bilateral swap arrangements, regional financing arrangements (RFAs) and finally, funds available at the IMF.

Another euro area measure to fight the crisis was the establishment of the ESM. This filled a gap in the institutional framework of the monetary union. The ESM is a lender of last resort for sovereigns that have lost market access during a crisis, a function that did not exist when monetary union was set up. The ESM enables countries to get their house back in order when they’re hit by a crisis. We can do this thanks to its high paid-in capital of €80 billion, which is provided by its shareholders, the 19 countries of the euro area. Our programmes mean countries have to reform and modernize their economies. They also bring substantial budget savings for them.

With the ESM, euro area governments have significantly increased the resources available under the GFSN. The most sizeable new layer introduced during the crisis are regional financing arrangements, of which the ESM is the world’s largest. On a smaller scale these had existed for several decades across various regions of the world. But Europe now adds the lion’s share of the total lending capacity of this layer of the GFSN. On top, euro area countries have made additional resources available to the IMF. Looking across the different layers of the GFSN, euro area countries added half of the overall enlargement since the start of the global financial crisis.

This package of measures was no accident. It fits in Europe’s tradition of cross-border cooperation and strong commitment to multilateralism. Not only have European countries strengthened their supranational ties more than is the case in any other region of the world. Europe has also supported multilateral cooperation beyond European borders.

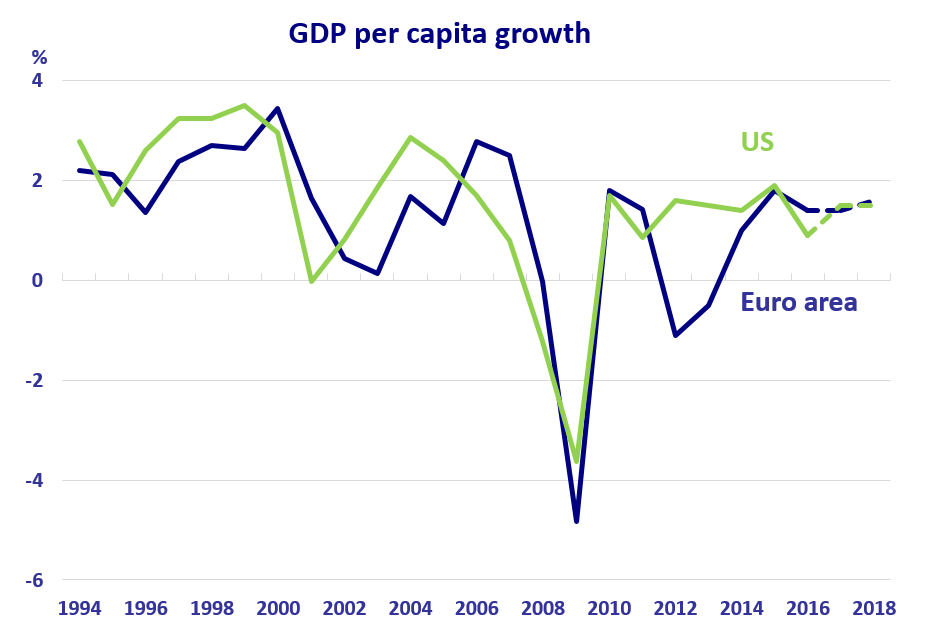

The results of these initiatives have been direct, and very tangible. The euro area economy is now embarking on a robust recovery and growing above potential. Per-capita growth is also back at the same level as that in the U.S. It used to be at the same level before the crisis. This shows that Europe is able to generate the same amount of wealth for its citizens as the U.S. economy, when abstracting from poor demographics.

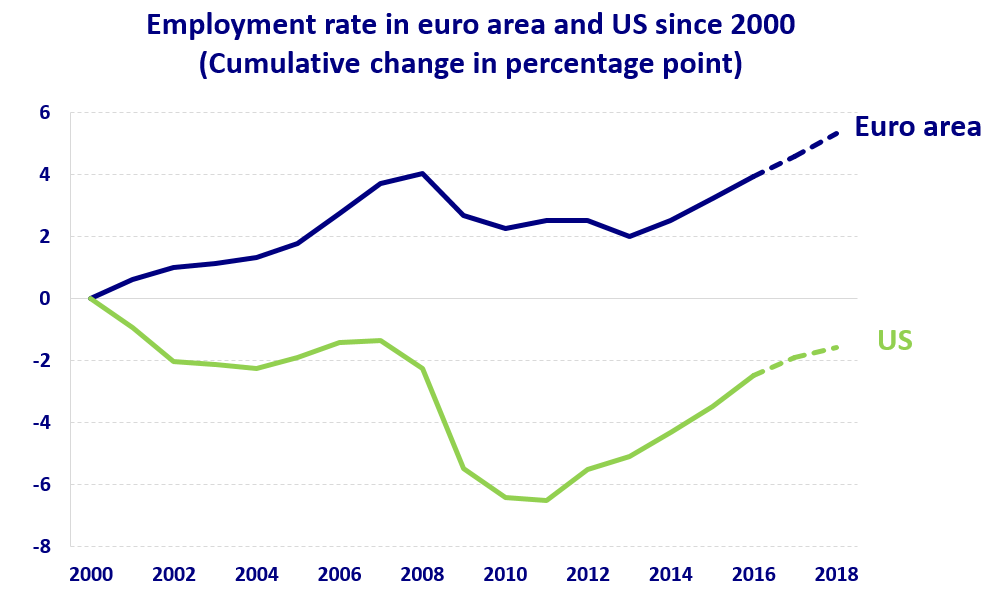

European growth has been more inclusive in two respects than in other countries. First, it has put people back to work. Growth was driven strongly by employment prior to the crisis. Obviously the crisis presented a drastic rupture, especially in those countries where the construction sector broke down. However, the employment rate in Europe has been rising since then, and is now higher than it was in 2000. In the U.S., it is still well below its 2000 level. In other words, more people in Europe are benefiting from the upswing. Increasingly we are also seeing the positive effects in a reduction of youth unemployment, despite the fact that it still remains intolerably high, particularly in some euro area countries.

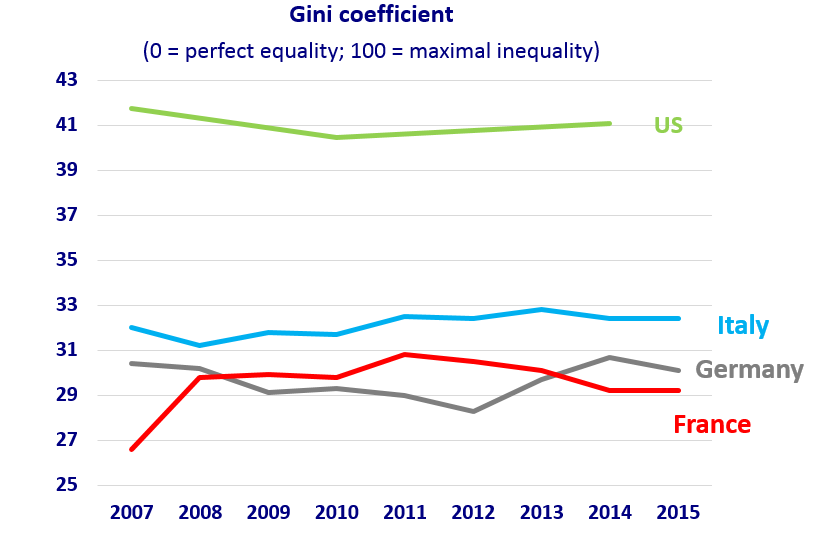

Secondly, euro area income distribution is much better than in the rest of the world. For instance when measured by the GINI coefficient which ranges from 0 to 100, with 0 expressing perfect equality. In the U.S., it stands at 41, but in France and Germany it is around 30. Inequality in disposable income of high income earners and the lowest income bracket continued to increase in the U.S during the last decade, but remained broadly stable in Europe. Rising inequality is a problem throughout Western societies, but Europe’s starting position and long term track record are simply far better.

This is particularly important, to counter the rising criticism of globalisation, and the negative side-effects it brings for some. It has historically been known that while cross-border trade is good for the global economy, and many economies as a whole, not everyone can be on the winning side. Unskilled workers in a country that has an abundance of them, for instance, or those in an industry that competes with goods that are imported, may suffer. The loss of employment among blue collar workers in the US is one of the explanations put forward for the resentment towards globalisation.

Fortunately European societies have offered much more of a helping hand. Our social model, which knows a far larger degree of solidarity, is simply superior in this respect. Europe’s populist parties have largely been defeated in national elections this year. The centrifugal forces that many feared could reverse European integration have been tamed, at least for now. Support for the euro is at its highest level since 2004. At the same time, and despite all this political tailwind, it is fair to say that Europe has not yet found a complete answer to migration as a new challenge emerging from globalisation.

Ladies and gentlemen, let me summarize. The euro area is the most open major economy of the world. Its strong commitment to remain competitive will ensure this will also be the case in the future. This will bring more jobs, and higher living standards. Europe’s social model means that its citizens will benefit from this on a more equal footing than is the case in other major economies.

III Further steps to make the euro more robust

The regained strength should not lead us to overlook weak spots. There are steps that Europe should take to make its economy more resilient. So let me now turn to the work that lies ahead of us.

First, Europe should strengthen its growth potential. Our poor demographics are a clear long-term restraint, and growth will have to come from investment and productivity gains. Structural reforms need to continue in all countries, not just in those who received an ESM assistance programme. Strengthening production factors is important for the convergence of the euro area economies. The existence of the euro sets the stage for countries with lower living conditions to catch up. The crisis has unfortunately led to significant divergence of per-capita income across countries. Now those countries hit more severely by the crisis are recovering more vigorously, with above average growth rates, also thanks to the reform measures they conducted as part of the ESM adjustment programmes. Conditions need to be put in place that this growth path continues, and supports long-term convergence. There is good evidence that this requires functioning product markets, high quality education systems, flexible labour markets, and strong financial supervision. These are also the conditions to tackle the legacies of the crisis – in particular unemployment and non-performing loans in banks, which lower bank profitability and restrict lending activity. European countries must work hard on structural reforms, without giving up on the European social model which has kept a more equal income distribution in place and supported those affected by the changes of globalisation to find a way forward.

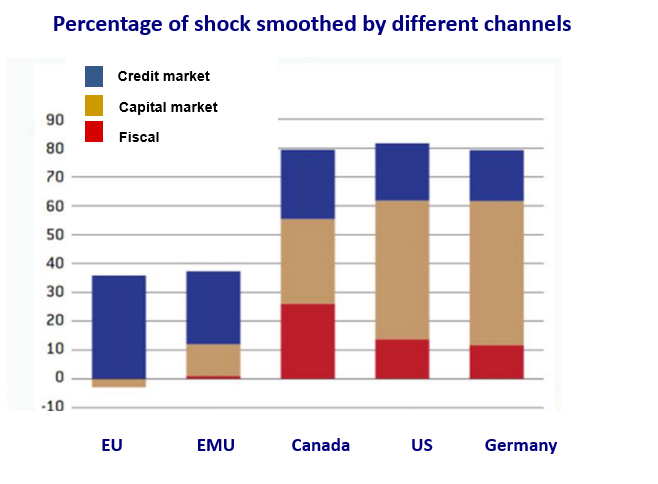

Another gap that the euro area needs to fill is economic risk-sharing. The comparison with the U.S. is telling. It shows that euro area countries are able to smooth economic downturns to a much smaller extent than the U.S. Important channels of risk-sharing are less developed. Capital market flows help U.S. states to weather economic fluctuations. In turn, financial integration in the euro area has declined during the crisis. The data show that financial integration quickly rose after the euro was introduced, as one would expect. It then crashed during the crisis, and while it has recovered since, it is still well below its peak. But we see also that there are more fiscal risk-sharing mechanisms complementing markets in the U.S. and in other federations, such as Germany. In short, this means that budget resources are used to stabilize the economies.

There are a few policy steps which can be taken at the European level to improve risk sharing. First, Banking Union needs to be completed. The Single Resolution Fund needs a financial backstop, to make it more credible, a role the ESM could take on. Europe also needs a common deposit insurance. This will happen only after legacy issues at banks in a number of countries have been tackled.

Secondly, the euro area should harmonize bankruptcy, tax and corporate law and move towards more a more harmonized capital market supervision to achieve a fully-fledged Capital Markets Union. This would ease the way for cross-border equity investments and open up new ways of funding for companies. It would also reduce our heavy reliance on bank funding, one of the reasons that Europe’s banking sector is so large in comparison to the size of the economy. Finishing the Banking Union and setting up the Capital Markets Union would be a big help in increasing risk-sharing in the monetary union.

There is also now a debate about simplifying the European Union fiscal rules. Initially laid out in the Maastricht Treaty and the Stability and Growth Pact, the rules have been tightened since the crisis. But they are now too complex, and hard to understand. So I welcome the debate on how to make them more effective. Better rules would help to create the fiscal space needed in future recessions.

A limited euro area budget is also under discussion. It could support the stronger fiscal risk-sharing we see in federal countries. In my view, we have a real need in the monetary union to create a facility that deals with asymmetric economic shocks. A country hit by an asymmetric shock would receive money during a crisis, but would need to repay it once it recovers. This is possible without permanent transfers between countries, or debt mutualisation. We certainly do not need a fully-fledged fiscal and political union in monetary union, nor is it politically in the cards at this stage. But significant further steps are being discussed, which can be pragmatic initiatives towards deeper political integration.

Ladies and gentlemen, I have tried to give you a comprehensive overview of Europe’s role in the global economy, and its comparative strengths now that we have emerged from the worst crisis since the Great Depression. The important lesson is that openness and competitiveness in a globalized economy is compatible with more inclusive, equitable growth. I have also given you a few steps that Europe is considering to take to make its economy more resilient and monetary union more robust. It is great to see that citizens have again become more cognisant of the benefits of the euro area and that there is political energy to pursue further integration.

Thank you for your attention.

Author

Contacts