ESM Seminar with Andrea Enria, EBA Chairperson

Speeches

ESM

Luxembourg

"European banks' risks and recovery - a single market perspective"

ESM premises, Luxembourg

Introductory remarks, Rolf Strauch

Member of the Management Board, Economics, Policy Strategy and Banking, ESMSpeech, "European banks' risks and recovery - a single market perspective", Andrea Enria

Chairperson, European Banking AuthorityRemarks, Klaus Regling

Managing Director, ESMBiography of Andrea Enria

Andrea Enria is the Chairperson of the European Banking Authority (EBA). Before assuming his current position, Mr Enria was the Head of the Regulation and Supervisory Policy Department at the Bank of Italy. He also served as Secretary General of Committee of European Banking Supervisors (CEBS), dealing with technical aspects of EU banking legislation, supervisory convergence and cooperation within the EU.Press contacts

Introductory remarks, Rolf Strauch

Member of the Management Board, Economics, Policy Strategy and Banking, ESMPlease check against delivery

Dear Andrea, Dear Klaus, dear members of the press, dear colleagues, ladies and gentlemen.

Welcome to the ESM. This is not the first conference we have organised. But it is the first one in this building. The previous two seminars were in the Philharmonie, on the other side of the Kirchberg. Our own facilities are a bit less glamorous, but very efficient and modern. In short, a perfect symbol of our organisation.

I will only speak briefly, to introduce today’s speaker. Andrea Enria has had a long career in the public sector and European institutions. He is the head of the European Banking Authority since it was set up in 2011. He was also the first head of the Committee of European Banking Supervisors, the CEBS. This was one of the three so-called Lamfalussy committees set up in 2004 to simplify the writing of new EU rules for banks, insurers and the securities industry. CEBS was also the predecessor of the EBA. So Andrea has worked at this institute in two different forms. It was always based in London and still is - though this is now about to change, because of the Brexit. In short, it is no exaggeration to say that Andrea is a founding father of EU banking supervision.

There are many more reasons why it is so wonderful to have you here, Andrea. One is the common background of our two institutions, the EBA and the ESM. Both institutions were set up during the crisis. The ESM was set up as a new institution, a lender of last resort to sovereigns, which is a function that did not exist in the institutional framework of EMU. It played a crucial role in stemming the euro debt crisis that started in 2010. Without the support we provided to five countries, the euro would likely have fallen apart.

The EBA equally played a prominent role in fighting the crisis. It was created in 2011 jointly with other European supervisory institutions as a first step to improve the common financial infrastructure for Europe. Tasked with new responsibilities, it is of course best known for the annual stress tests of the European banks. With Banking Union, euro area countries then took the next step and created the Single Supervisory Mechanism.

Still at the European Level, EBA remains the institution enforcing the single rule book and you also determine parameters of stress testing. This new set-up in prudential supervision has made European banks much safer than before the crisis.

But the common ground between our two institutions is not just because of our history. It is, secondly, also because of the interest that we take in European banks, in our case specifically for programme countries and because of the impact they have on the European economy.

In some of the programme countries, banks were the main problem. This required significant know-how at the ESM on the industry, during the negotiations and later during programme implementation and post-programme monitoring.

The ESM has two instruments that are directly designed to deal with problems at banks. Only one of these, the so-called Indirect Bank Recapitalisation was used, in Spain. In Greece and elsewhere we also recapitalised the banks, even though the instrument used in these cases was a regular loan as part of an adjustment programme.

Our programmes resolved many problems at the banks. Banks in programme countries are now much better capitalized. Still, it will still take some time until one can argue that all problems have been addressed and the banking system is entirely cured and healthy in those countries.

Given all this, it should be no surprise that we spent some considerable time on analysing Europe’s banks internally. But it’s something the outside world does not normally hear about. We are here to listen to what Andrea has to say about the current state of Europe’s banks. So I won’t pre-empt that. Judging by the newspaper headlines, you would be forgiven for thinking that a next banking crisis is around the corner. Here at the ESM, we emphatically think that is not the case.

It is of course true that European banks are still slowly catching up with their U.S. peers in terms of profitability and leverage. And they are still dealing with legacy issues. Many have difficulty adapting their business models to a new market reality determined by tougher regulation and, importantly, new technologies.

Certainly, in some countries such as Italy there are problems with individual banks that need to be sorted out. But that’s not to say there’s a sector-wide problem in those countries. I will leave it at that, because I am sure that Andrea has much more to say on these issues.

Let me finish by making two housekeeping remarks. This event is on the record. Anything we say may be reported. And second, we encourage you to send Tweets. You may use the hashtag that you see pasted here on these big screens: #ESM_Enria.

With that Andrea, I hand over to you.

Slides accompanying speech, "European banks' risks and recovery - a single market perspective", Andrea Enria

Chairperson, European Banking Authority

Remarks, Klaus Regling

Managing Director, ESMPlease check against delivery

Welcome, Andrea, to the ESM, also on my behalf. Thank you for your views.

You have made some interesting points on NPLs and on a European bad bank that I will return to. The stability of banks and the stability of the euro area economy are highly correlated topics.

Your institution deals with the first, mine with the second. But at the ESM, we also spend time thinking about European banks, in relation to our stability mission.

In that light, I’d like to say a few words on financial integration. More cross-border banking and financial market activities would increase the stability of the EU economy. This is because more financial integration would mean more economic risk sharing. Europe has made tremendous progress since the crisis. But the one area where the EU – and the euro area – are still lagging behind the US is economic risk sharing.

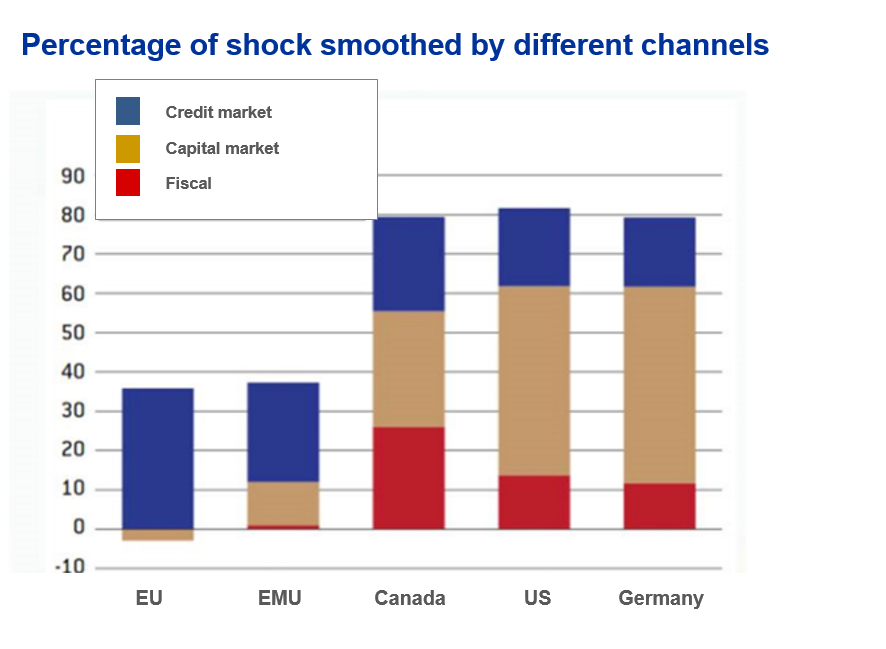

[SLIDE 1]

Risk sharing is the sum of mechanisms through which a shock to one country’s economy is shared by others. It helps smooth business cycles and makes national economies more resilient.

In the U.S., shocks are evened out to a much greater degree than in the EU and in the euro area.

Even inside large countries such as Germany and France, it is more developed than across the euro area. We need to address this lag, because more risk sharing would make EMU more robust, and its economy more resilient.

Risk sharing can take place through different channels: fiscal channels, or through financial markets. Today, I won’t discuss fiscal issues or fiscal transfers. I’ll focus on risk sharing through financial markets, which is closely related to financial integration. The more countries are financially integrated, the more risks they will share.

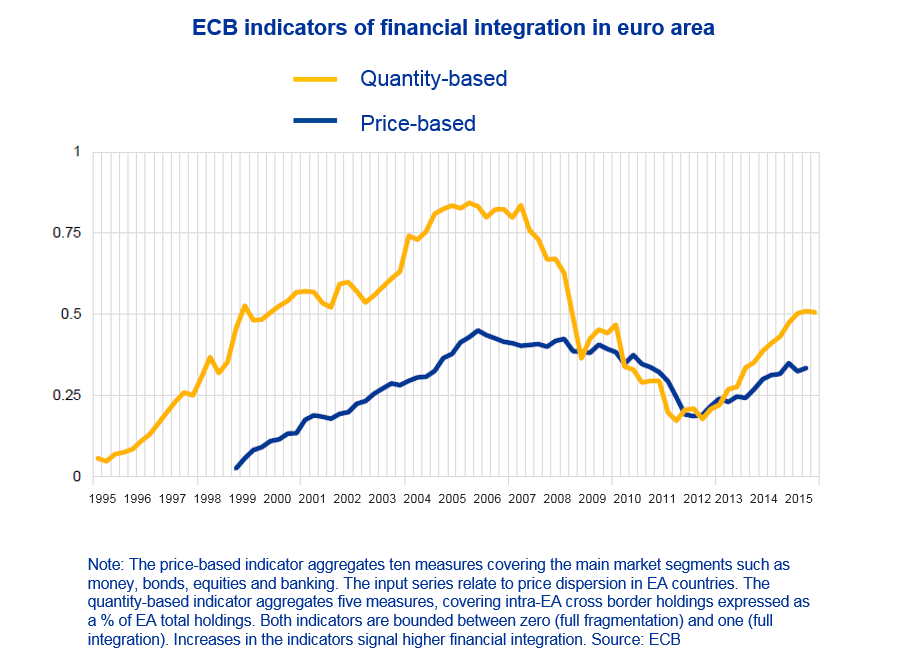

[SLIDE 2]

Now let’s look at how financial integration has been doing since the start of the single currency. This ECB chart shows that monetary union clearly promoted financial integration during the first 10 years of its existence. But fragmentation dramatically returned during the crisis. More recently, financial integration has resumed, though it still remains well below its peaks. Cross-border banking remains the exception rather than the rule, and banks and their clients have a much stronger home bias today than before the crisis. As I said, this hinders economic risk sharing, and therefore makes the euro area economy less resilient.

Andrea, as you have shown with a lot of data, low profitability and legacy issues are an important explanation of why cross-border banking has suffered. Therefore, banks need to aggressively reduce NPLs, which are keeping down profitability, particularly in some countries.

That is why I welcome your idea for an Asset Management Company as a valuable policy proposal. Your plan for a European bad bank does not foresee mutualisation of risk, which politically is an advantage. You identify steps to help establish a market solution. As you said, there are many issues that need to be sorted out: corporate governance, funding and the role of governments. The AMC will have to issue billions of euros of debt. That is no simple task – I speak from experience, because it is what we do at the ESM. Some role for the public sector is probably needed.

Another complication will be the sheer complexity and size of the newly established entity.

The target is to move €200/250 billion of NPLs to the AMC. This means you would have to transfer millions of loans. In Greece alone, there are more than half a million corporate and SME NPLs.

One lesson we learnt from working with programme countries is that a bad bank should also function as a “work-out bank” which resolves the over-indebtedness of borrowers. It should not just be a vehicle to clean up the balance sheets of banks, so as not to simply shift the problem between the public and private sector. If the problem of over-indebtedness is not dealt with, it will come back to haunt us later.

In summary, your proposal is very valuable. But we should lose no time tackling the important issue of NPLs. That is why I suggest other measures be taken in parallel while we work through the complexities of an AMC. The ECB has already started a programme assigning targets to banks to reduce NPLs. And your ideas for a platform with high quality and consistent data or an EU servicing regime to facilitate securitisation would be major steps forward that could be relatively straightforward to implement.

A comprehensive solution to addressing the issue of NPLs would be beneficial for the euro area economy because it would help banks to provide more credit. And, equally important, it would help financial integration.

To that end, we should also work to complete Banking Union. Two pillars have already been set up: the Single Supervisory Mechanism in Frankfurt and the Single Resolution Board in Brussels, which can wind down failing banks. We still need to create a financial backstop for the Single Resolution Fund, and set up European Deposit Insurance. This second issue is controversial, but in the longer run -- after de-risking and after legacy issues have been sorted out – a European Deposit Insurance would reduce the vulnerability of EMU, and strengthen financial integration.

Much work also remains to be done on Capital Markets Union which is high on the agenda of the European Commission. CMU would also strengthen financial integration, risk-sharing and thus resilience of EMU.

Now I don’t want to sound as if the EMU still needs a lot of work. That is far from the truth.

Europe has made tremendous progress since the crisis. Mostly because national governments did their homework, so that fiscal and current account imbalances have disappeared to a large extent, and competitiveness has been restored. We have also tightened economic coordination and monitoring procedures across Europe. I already mentioned progress in Banking Union since the crisis. And last but not least, my own institution, the ESM, is a crucial element of Europe’s response to the crisis.

In conclusion, I believe that Europe has come out of the crisis much stronger than before. Of course, there are challenges and our two institutions, EBA and ESM, have enough work to do.

Andrea, you talked about some of these challenges in your introduction.

Perhaps you would now like to react to my thoughts.

Contacts

Deputy Head of Communications and Deputy Chief Spokesperson

+352 260 962 551