The ESM backstop in practice - speech by Nicoletta Mascher

Nicoletta Mascher, ESM Head of Financial Sector and Market Analysis

Initial remarks for panel discussion “The ESM backstop in practice”

European Banking Institute (EBI) webinar

Online, 24 February 2021

(Please check against delivery)

[ESM Chief Economist] Rolf Strauch has just highlighted the benefit and the importance of completing banking union for a more stable and efficient banking system in the euro area.

Moving resolution to the European level has helped to strengthen the system. All stakeholders are now more confident that the system can deal with banks’ failures in an orderly manner and address potential contagion effects.

Given the architecture of banking union, the banking sector itself has to finance the resolution regime through annual contributions to the Single Resolution Fund. Moreover, banks’ shareholders and creditors have to bear part of the losses.

However, there could be a situation where the funds available are insufficient for executing a resolution strategy, for example if the SRF has been used to support resolution of multiple large banks, or in a severe crisis. That is why the creation of a common backstop was agreed upon in 2013.

The ESM backstop will double the resources available for bank resolutions in the banking union, which are set at 1% of covered deposits of all institutions authorised in the banking union. The backstop facility will work as a revolving credit line. Let me describe how exactly the backstop would function.

The Single Resolution Board, or SRB, manages the Single Resolution Fund. If a bank gets into distress, the ECB or the SRB may initiate a procedure to declare the bank is failing or likely to fail.

Already at this point, we at ESM could receive a pre-notification if a resolution action is likely and the available funds are deemed insufficient.

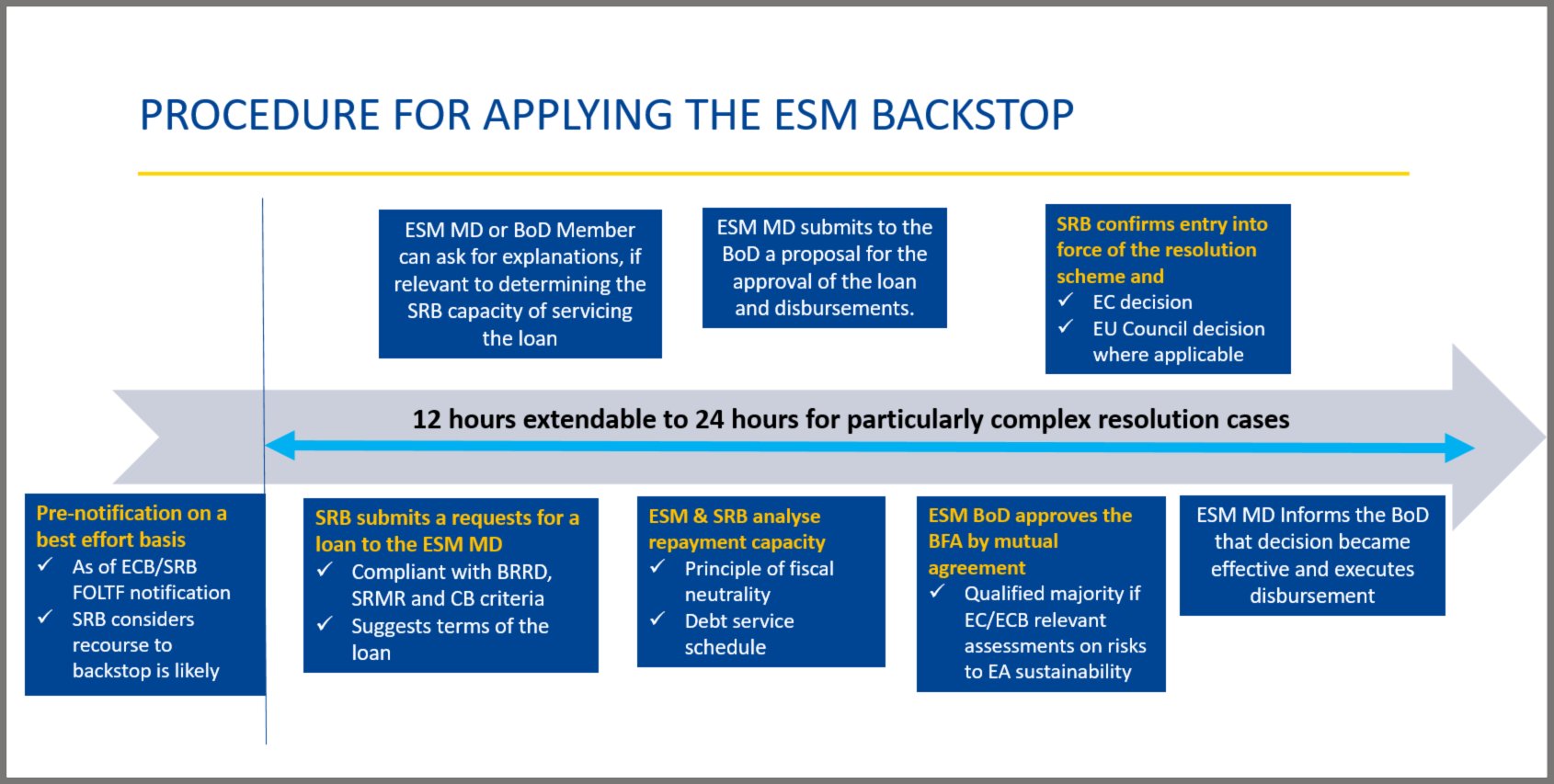

The disbursement process will only start after the ESM receives a formal request for a loan. This happens after the SRB has determined that a resolution is in the public interest, and that there are no private or supervisory measures available that can restore the bank’s viability within a reasonable timeframe.

How will we inform our decision? As the SRF is funded by bank contributions, banks themselves will remain the ultimate debtors of the ESM and not taxpayers. Before deciding to disburse, we will assess, jointly with the SRB, the recoupment capacity of these funds from the banking sector within the maturity horizon of our loans.

Allow me to elaborate on the fundamental features of the common backstop:

- Loans under the backstop facility may be granted to the SRB only as a last resort. Recourse to additional resources can be sought only when the funds provided by the banking sector itself have been depleted and the SRB is not able to borrow on terms and conditions considered acceptable by the SRB itself.

- The backstop is fiscally neutral in the medium term: public assistance will be fully recouped by means of ex post contributions levied from the financial industry. In this respect, loans under the backstop facility can be considered as an advance on the expected inflows of ex-post contributions that will be levied by the SRB to replenish its funds and repay any external borrowing.

- Loans can be extended on very short notice for any of the purposes set forth in the SRM Regulation, including liquidity provisions. The provision of loans for liquidity purposes is subject to additional safeguards, also in light of the fact that liquidity support might occur without bail-in.

So the fundamental features of the backstop are that it acts as a lender of a last resort, it is fiscally neutral and the loans can be extended on very short notice.

The backstop is safeguarded by a thorough risk-monitoring framework. This risk-monitoring framework includes:

- A pre-monitoring framework: the ESM, jointly with the SRB, is putting in place a pre-monitoring framework to be ready to intervene on very short notice (namely within 12 hours, extendible up to 24 hours for complex resolution operations). Prior to any request for a loan, we will regularly assess the repayment capacity under different scenarios, at least once a year.

- An early warning system: once a loan is outstanding, the assessment of the repayment capacity will feed into an early warning system on a quarterly basis to monitor the servicing of the loan. This will include additional inflows and outflows that may affect the SRB’s own repayment capacity other than banks’ contributions, should the ex-post contributions levied from banks not suffice.

In summary, we believe the introduction of the common backstop will greatly enhance the bank resolution framework for three reasons:

- Whether called upon or not, the backstop makes the safety net stronger; it will reassure markets and stop contagion effects.

- The backstop will help to decouple the sovereign-bank nexus. As a result, governments will no longer be forced to rescue failing banks, which will also avoid disrupting their economies.

- The new tool is in line with the overall banking union architecture as it is a common instrument, centrally administered and managed through a thorough and independent risk assessment framework.

Author

Contacts