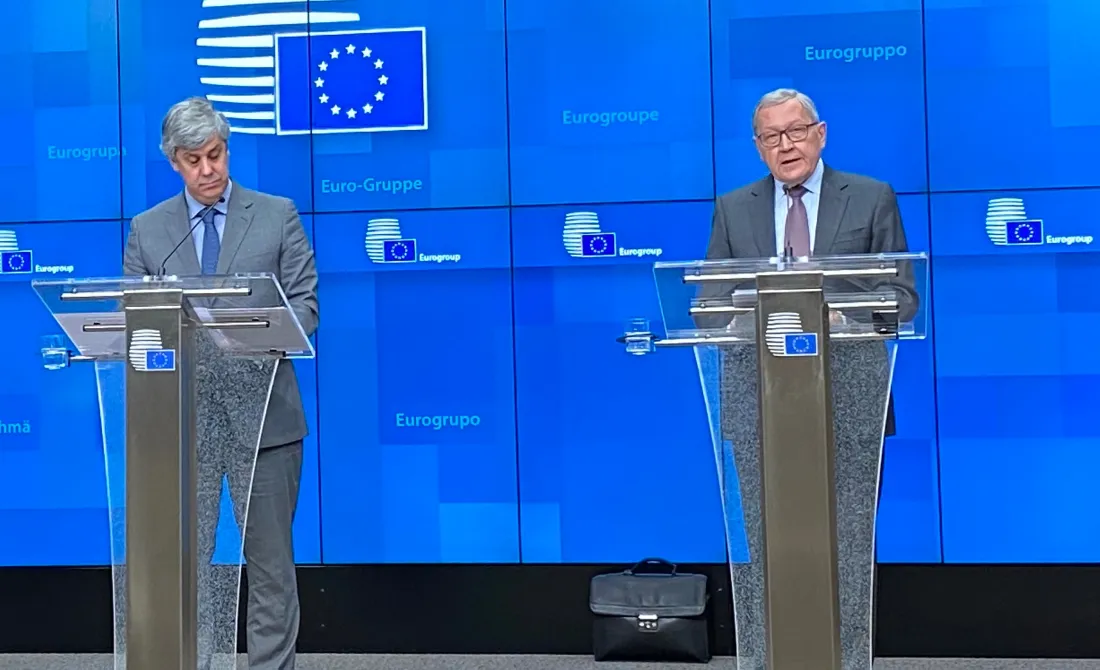

Klaus Regling at Eurogroup press conference

Press conferences

ESM

Transcript of remarks by ESM Managing Director Klaus Regling

Press conference after Eurogroup meeting

20 January 2020

Press conference after Eurogroup meeting

20 January 2020

Good evening. I will focus on ESM reform, of course. We have come a long way. There are not many open issues, as the Chairman said. These are mainly now issues of process, not so much of substance. And it's realistic that a final agreement on the ESM Treaty can be reached by March, so that the ratification process can start then. This enhanced role of the ESM will strengthen its mandate of ensuring financial stability in the euro area, and that's good for everyone. The ESM will then act as a backstop for the Single Resolution Fund (SRF) so that when the SRF's resources are depleted, the ESM can lend the necessary funds to finance a bank resolution.

The ESM will also be more involved in the design of future programmes and following country developments, of course, together with the European Commission. In addition, ESM's precautionary credit lines will be more effective to prevent small problems from becoming big problems. But a stronger ESM is not a goal in itself. The ESM reform is part of a comprehensive package of measures to deepen monetary union, including work on completing banking union with the common deposit insurance, capital markets union and the budgetary instrument for convergence and competitiveness (BICC). The Chairman and the Commissioner talked about that.

This agenda for deepening Economic and Monetary Union (EMU) is also supported by the IMF. That was discussed in the early part of our meeting today. And these steps to deepen EMU further will also promote the international role of the euro.

A quick word on Portugal. I can also add from the ESM's perspective, we are the largest creditor of Portugal, like for several other countries. The progress that Portugal has made is remarkable. Also, from a market perspective, one can see very clearly the progress. There is good market access, low interest rates, the rating profile has improved substantially across all the different rating agencies because of good economic growth and prudent fiscal policies. And the updated 2020 draft budgetary plan is a good step to continue on this course. In the current economic environment, the government should remain mindful and we know that the finance minister is mindful of risks. Risks on the export side, on competitiveness. On growth, which also could spill over to revenue performance. But these are the risks that we are all aware of. Thank you.

Response to question on Greece and the meeting the Greek finance minister had with the Commission and the ESM and if changing primary surplus targets was mentioned.

The meeting today is part of the dialogue that we have, which is good, because the ESM has disbursed around €200 billion to Greece. So we are very interested in economic developments there. The joint mission – the Commission and ESM – with the participation of the ECB, is in Athens right now. So that’s the right opportunity to review the situation, to see whether our growth forecasts are still appropriate. The latest indications are actually a bit more positive than what we thought two months ago, but all that needs to be confirmed. There are other factors that affect the debt sustainability analysis, so all that will be assessed by the institutions together, and then we will report to the Eurogroup, probably in two months.

Contacts

Deputy Head of Communications and Deputy Chief Spokesperson

+352 260 962 551